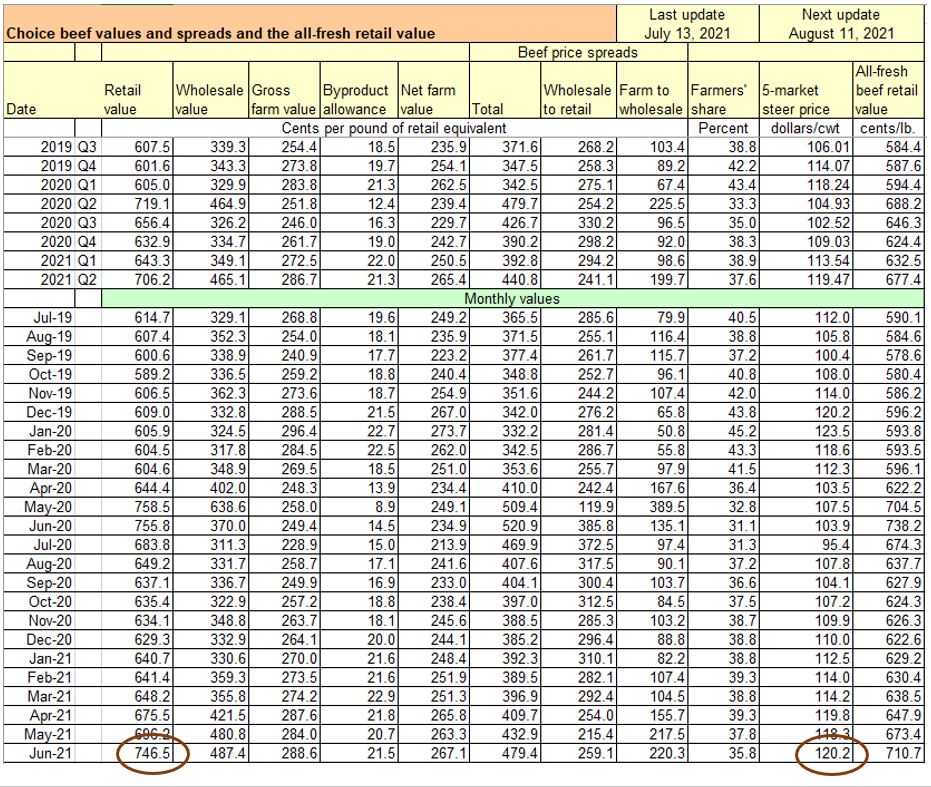

The USDA retail beef price report from July 13, 2021 quotes the average Choice beef price at $7.46 per pound with the average live cattle price at $120/cwt.

A finished cattle weight of 1,400 lbs. x 42% retail yield = 588 lbs. of saleable retail beef/head. x $7.46/lb. = $4,386/hd. value at the consumer retail level.

A finished cattle weight of 1,400 lbs. x 42% retail yield = 588 lbs. of saleable retail beef/head. x $7.46/lb. = $4,386/hd. value at the consumer retail level.

This doesn’t include big meatpacker income from drop credits of approximately $190/hd. or the higher value Prime beef and branded products like Certified Angus Beef.

The chart shows farm share at 35.8%.

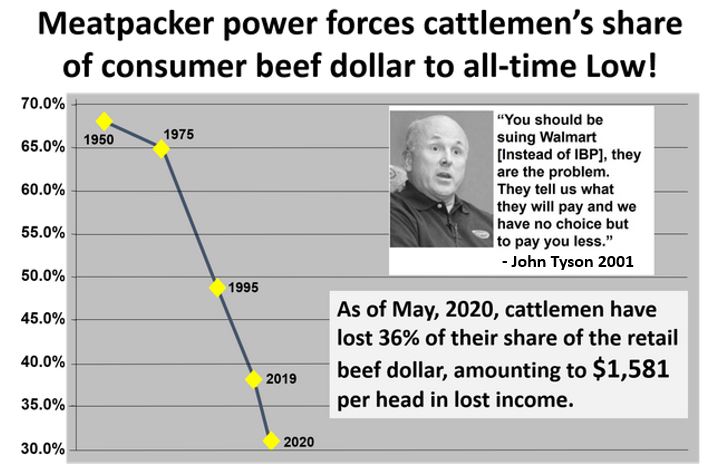

If we were still receiving 65% of the consumer dollar from a market with many buyers and high levels of competition as in the 1970’s, the producer would be receiving $2,851/hd. or $2.03/lb. live wt.

Ranch Foods Direct custom-cut cattle customers that sell direct to their customers have received around 79% after paying the costs for slaughter and processing. So, who is more efficient?

The declining farm share of the the retail food dollar is an indicator of market power and proof of the inefficiencies and unfairness of the existing monopolized Big Food system, that according to the above USDA chart, is leaving the struggling cattle producer with a bankrupting 35.8%.

$120/cwt. live cattle price ($1.20 per pound per chart) is 83 cents per lb. less ($2.03-$1.20) than a competitive market should be paying, for a loss to the producer of $1,171 per head, and a drastic decline in rural economies.

Building new local/regional, decentralized food systems, along with better government policy can help fix this threat to our food and national security.