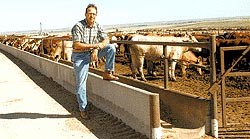

Mike Callicrate says he was nearly driven out of business by a packing company that refused to buy cattle after he wrote an article criticizing the company. (Karen Krien/Special to The Wichita Eagle)

Market dominance of huge agribusiness firms has some farmers crying foul; others say it’s a natural evolution of the industry

SUNDAY August 22, 1999

By Eric Palmer

Knight Ridder News Service

A vocal critic of the power of big business, Kansas feedlot operator Mike Callicrate believes his stand just about cost him his business this year. In January it had been weeks since his best customer, Farmland National Beef Packing, had bid on cattle.

Callicrate had written a livestock journal article criticizing National’s move into buying cattle on contracts. He thinks contracts depress cash prices at feedlots like his, a 12,000-head operation near St. Francis in northwest Kansas. He heard National was mad about the criticism.

“They went from buying most of our cattle to buying nothing,” Callicrate said. “It meant bankruptcy pretty damn quick.”

“Without question, they are exerting abusive market power,” said Callicrate

Callicrate notified the U.S. Department of Agriculture of his suspicions, then set about preparing to close his feedlot. The USDA filed a complaint against Farmland National for blacklisting Callicrate, a charge the company denies.

Callicrate says the government’s inquiries prompted other packers to take up the slack and he staved off closure, although he says he lost tens of thousands of dollars. He thinks the episode represents an abuse of market power being wielded regularly against small operations by agribusiness companies that have been merging into global giants.

“Without question, they are exerting abusive market power,” said Callicrate, who also is a party to a lawsuit over similar alleged practices against IBP, the nation’s largest meat packer. “We have companies today that are so large they are almost bulletproof. They have so much money and so much political power that it is almost impossible to get justice.”

Suspicion always has tinged the dealings between independent-spirited farmers and the pin-striped corporations to which they sell. That suspicion has magnified the last two years as mergers in the agriculture industry have left farmers with fewer buyers for their crops and livestock even as prices have been free falling and family farms have succumbed.

Large agribusiness companies deny they are acting anticompetitively. Agriculture economists say it is normal market forces, not monopolistic power, driving both the mergers of large companies and the collapse of commodity prices.

“It certainly begins to limit our choices,” said Mark Taddiken of the mergers. He raises soybeans, corn and milo near Clifton in north central Kansas. “Whether that’s bad or not I guess time will tell.”

Dealing with big business

Farmers such as Taddiken have little choice but to do business with the giants of agriculture. Huge agribusiness firms supply the seed, fertilizer, machinery and chemicals that farmers need to produce crops and livestock. They also buy most of what farmers produce.

Taddiken and thousands of other farmers have signed agreements with Monsanto Co. that would have been unheard of not long ago.

That’s not all bad, he said, because big companies have the resources to develop products that — when marketed fairly — can benefit the farmer and the company alike. In the past three years, Taddiken and thousands of other farmers have signed agreements with Monsanto Co. that would have been unheard of not long ago.

Through its biotechnology research, Monsanto developed soybean plants that are not killed by Roundup, a cheap and effective weed-killer also developed by Monsanto. It cuts his herbicide costs to about $15 an acre, rather than the $25 to $40 an acre he had been spending.

But there’s a catch: A farmer who grows the Roundup-ready beans signs a contract agreeing not to save any of the soybeans for replanting the next year, or for selling to other farmers for replanting. The agreement gives Monsanto the right to review farmers’ production and sales figures — information farmers typically share only with their banker.

The penalty for violating the terms of the contract can be stiff.

Taddiken has no regrets.

“You make an agreement and if you keep it, everything’s fine,” he said.

And he can’t argue with the results. Last week, as he took a visitor on a tour of his farm, a Roundup-ready field on one side of the road was lush with soybeans and nothing else. On the other side, in a field planted with a traditional variety, weeds were nearly as plentiful as soybeans.

“We’re controlling weeds that over the years have been difficult to control,” Taddiken said.

Still, as he looks at what’s happening in agriculture, he’s concerned about the future. Seed companies and crop protection companies are merging, he said, and they’re starting to get involved in processing farm products as well. That puts the companies in a powerful position to determine what is grown on farms and what will be done with the crops.

“You begin to wonder, down the road, whether we’ll just be contract growers,” Taddiken said. “I don’t think there’s a big evil plan out there against us. I just think that’s the way the industry’s headed.”

An industrial model

Many agriculture experts say the loss of family farms is the result of an agricultural system that is rapidly, and inevitably, becoming more industrialized.

They say farming is fast becoming about bigger farms, global markets, contracts with meatpackers to sell genetically specific livestock, contracts with grain companies to grow genetically specific crops, high-technology systems and competition from corporate farms.

The farmers who will survive this transition, they say, will be distinguished as much by their grasp of technology and their business acumen as by their skill at growing a healthy field of corn.

Some family farmers are themselves indirect players in the merger game as their farm cooperatives join forces to better compete.

In May, the nation’s two largest farm cooperatives — Farmland Industries of Kansas City, Mo., and Cenex-Harvest States of St. Paul, Minn. –announced plans to merge. It would create a system with about $17 billion in annual sales.

Those co-ops are owned by hundreds of local co-ops which, in turn, are owned by farmers.

If small farmers are to survive, their cooperatives must learn the lessons of global competition, said Harry Cleberg, chief executive of Farmland — which, incidentally, owns Farmland National Beef, the packing company Callicrate clashed with.

“Wal-Mart figured out a more effective way of delivering products from the manufacturer to the consumer. Those competitors who couldn’t adapt died off,” Cleberg said. “For a producer to be a player rather than a hired hand, so to speak, we must put together a cooperative that has a better, more cost-efficient, supply chain.”

Mergers in agribusiness have become as commonplace as those in banking or telecommunications. In recent years Monsanto merged with DeKalb Genetics Corp. in a $2.3 billion deal, then picked up a leading cotton seed producer for $1.9 billion.

Dupont spent $7.7 billion to buy seed company Pioneer Hi-Bred. Farm implement maker New Holland has offered $4.3 billion to buy competitor Case Corp.

Minnesota-based Cargill, the nation’s largest grain buyer, last month acquired the worldwide grain operations of Continental Grain Co., the second-largest. At an estimated $400 million, it was small compared to other mergers, but it bothered many farmers and got reaction from members of Congress.

The deal was approved by the U.S. Justice Department only after Cargill agreed to sell off elevators in areas where the department said Cargill would have too much market muscle.

The facts of the market

“If these companies become more efficient, and if we maintain competition, they should lower costs and the farmer benefits,” Flinchbaugh said.

The economics that have led to mergers are simple, explained Barry Flinchbaugh, an economist with Kansas State University. Bigger companies can lower their costs by producing more product in bigger facilities with fewer people. Where some farmers see conspiracies by big business to lower farm prices, he sees economics at work.

“If these companies become more efficient, and if we maintain competition, they should lower costs and the farmer benefits,” Flinchbaugh said.

Economists point to the fact that even as food companies have gotten bigger, U.S. consumers have spent a declining amount of their disposable income on food, 10.8 percent last year, down from more than 13 percent in 1981.

More of that food dollar is going to wholesalers and retailers, acknowledged Bill MacLeod, an attorney for the Grocery Manufacturers of America. The difference, MacLeod said, has to do with further processing of food.

“Especially ready-to-eat foods,” MacLeod said. “There is more labor and more expense now between the farmer and the consumer.”

U.S. agribusiness companies say the mergers reflect their need to get market position to compete with some of the largest companies in the world.

Frank Sims, president of Cargill’s North American Grain operations, said the merger with Continental was part of a restructuring of the food and agribusiness industries that is being mirrored at the farm level as they adapt to new trends.

“Producers are changing faster than we are. In terms of consolidation, all the data I see from USDA suggests that there is as much consolidation and restructuring on the farm,” he said.

Agribusiness companies are getting bigger, but so are farms. That has been the trend for at least 50 years, said Dick Gady, chief economist and vice president of public affairs for ConAgra in Omaha, the nation’s second-largest food company.

Gady said his company hates that the trend has raised suspicions among its customers.

“It bothers us that legislatures are villainizing agribusiness companies. It bothers us that our suppliers mistrust us,” Gady said. “I think higher prices and better markets would dissipate a lot of that, although not all.”

Let’s make a deal

About 18 months ago, Dale Whiteside and his sons made a decision that dramatically changed the way they farmed. It also put them among those undertaking one of the most controversial practices in agriculture, one that underscores farmers’ concerns about how corporations are changing their place in the world.

“We used to be totally independent. Now we grow and finish, but we don’t own the pigs.”

They decided to raise pigs on contract for Farmland Industries.

The Whitesides used to own sows that produced the pigs they would raise and sell at market for the best price they could get. Now, Farmland delivers 10-pound pigs to their farm and the rations to feed them. They will raise about 28,000 pigs this year and get paid per pig for taking care of them until they are ready to be slaughtered.

“We used to be totally independent. Now we grow and finish, but we don’t own the pigs,” Whiteside said from his farm near Chillicothe, Mo.

With the contract, they were able to get the financing to build the facilities they needed to compete with corporate hog farms, Whiteside said. It also saved them when hog prices last year dropped to their lowest point in decades.

“It wasn’t my druthers. I liked being independent, but the train was coming down the track,” Whiteside said. “It looked to me like it was time to share the risk with someone in packing.”

Vertical integration, where large corporations own a product from farm to plate, has become controversial on several levels. It has put companies in competition with the farmers they traditionally have bought from. It eliminates the need for much of the expertise of farmers. The companies determine the breeding of the animals and what they are fed.

There are advantages to the large meat processors being able to buy much of the livestock through contracts, said Gady of ConAgra.

“We like it because we can buy genetically the kind of animals we need to satisfy consumers,” Gady said. “We’ve got these monster plants we have got to fill up every day. It does help to have at least some of that contracted.”

It is not a one-way street, however, Gady explained.

“It gives producers a guaranteed market. It can reduce their pricing risk, which can help them get financing,” Gady said. It also pays producers a premium if they raise higher-quality animals, he said.

If any good comes out of low commodity prices, some farmers think, it will be that the hardship got Washington to pay attention to their concerns over concentration.

The Justice Department has agreed to look closer at concentration in agribusiness.

The Senate is considering legislation that would require meat packers nationally to report each day’s prices to the USDA.

The USDA, which has authority over consolidation in the meat packing industry, is again looking at that industry for signs of anti-competitive practices.

The USDA has investigated the situation several times but never found evidence that concentration has caused “tangible harm” to livestock producers.

“Meat packing has gotten more concentrated, leaving farmers with less bargaining power,” said U.S. Secretary of Agriculture Dan Glickman. “We are looking aggressively at how to get farmers more bargaining clout.”

A University of Missouri study showed that four large firms in each sector buy and slaughter four out of five beef cattle, three out of four sheep, three out of five hogs and half of all chickens.

The USDA has investigated the situation several times but never found evidence that concentration has caused “tangible harm” to livestock producers.

Regulators warn they cannot stop the transformation of agribusiness being driven by technology and globalization, but maybe they can mitigate some of the adverse effects.

“Some people are going out of business. That is the state of things,” said Keith Collins, chief economist for the USDA. “While we cannot intervene in markets, we can ensure fairness and competition.”

Contributing: Steve Painter of The Eagle, Lance Nixon in Aberdeen, S.D., Worth Wren in Fort Worth, Texas, Kevin Bonham in Grand Forks, N.D., and Lee Egerstrom in St. Paul, Minn.