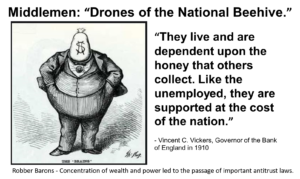

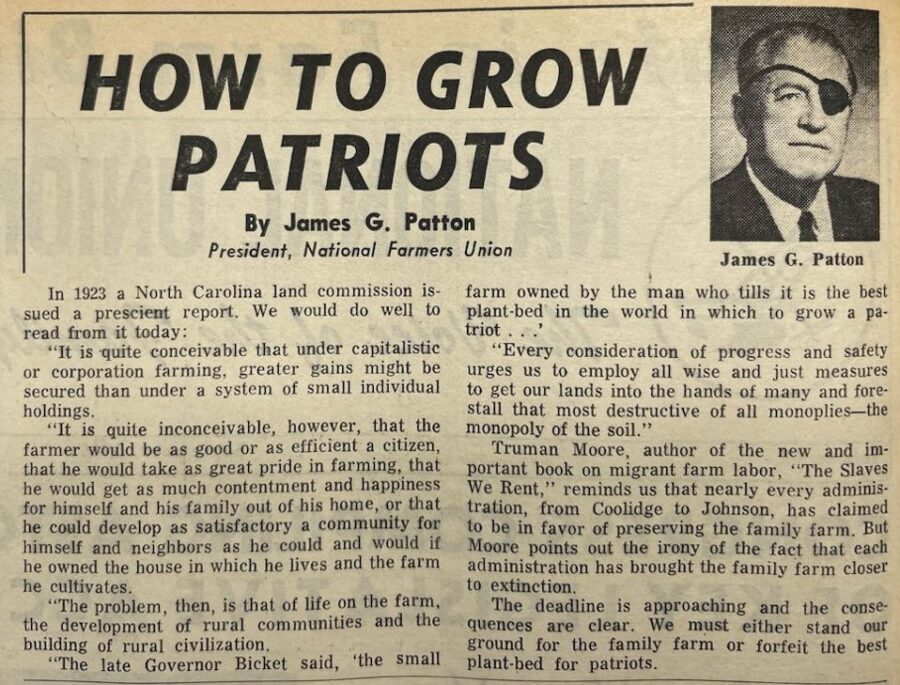

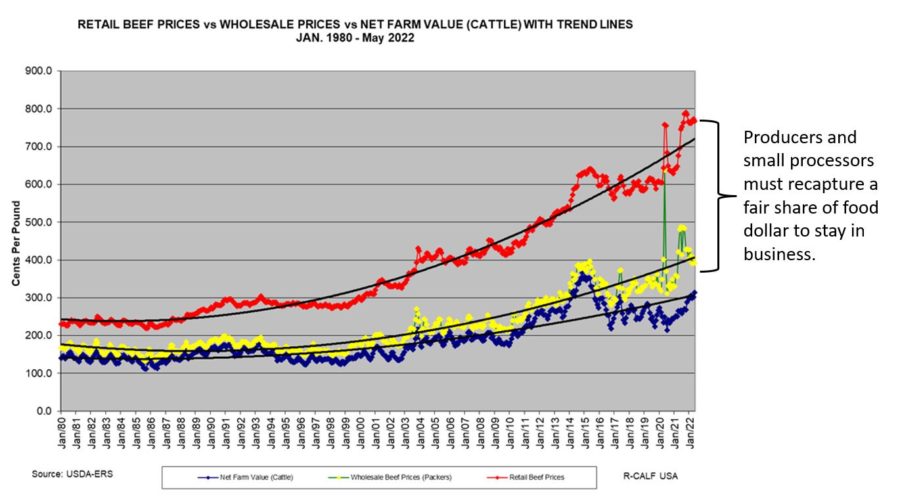

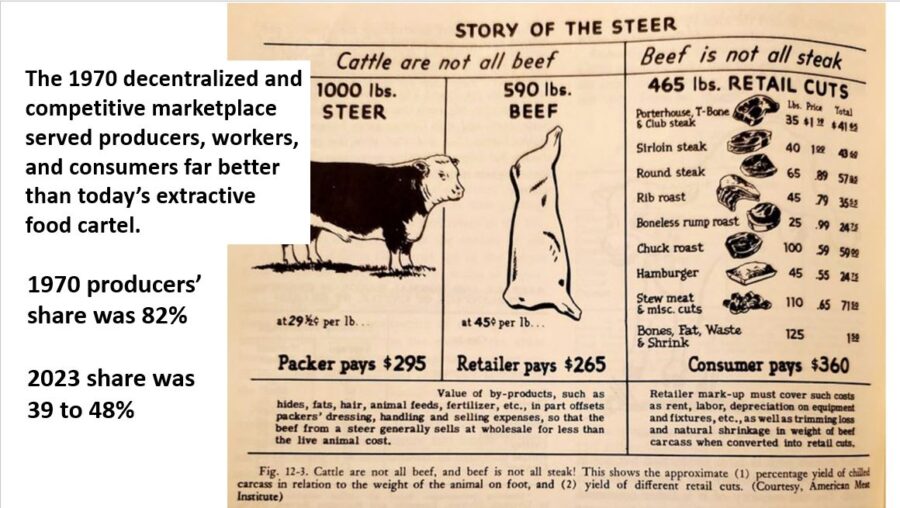

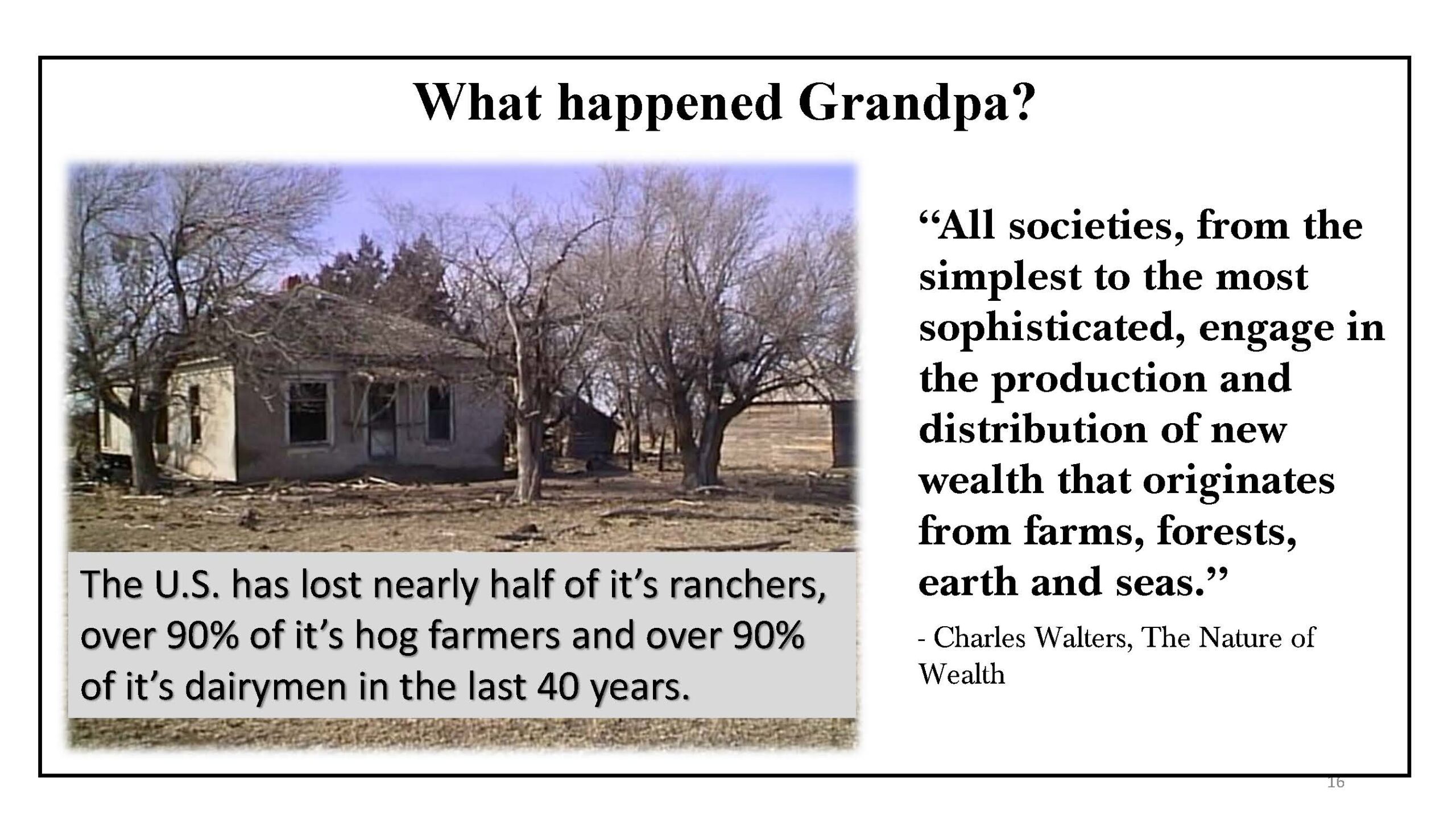

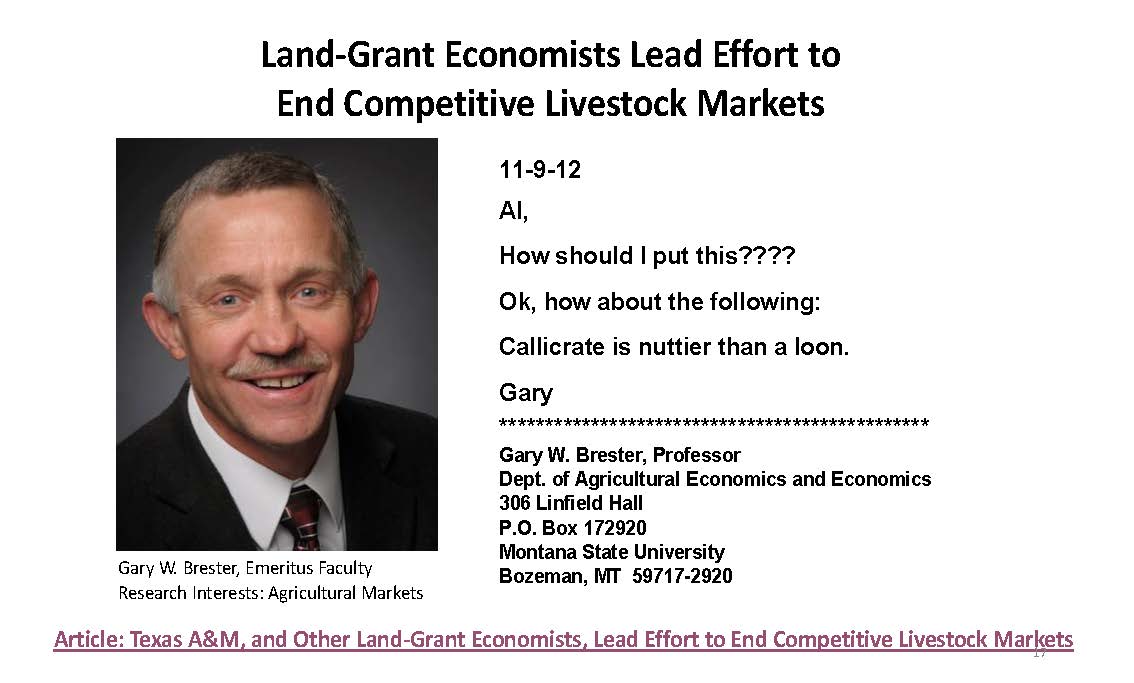

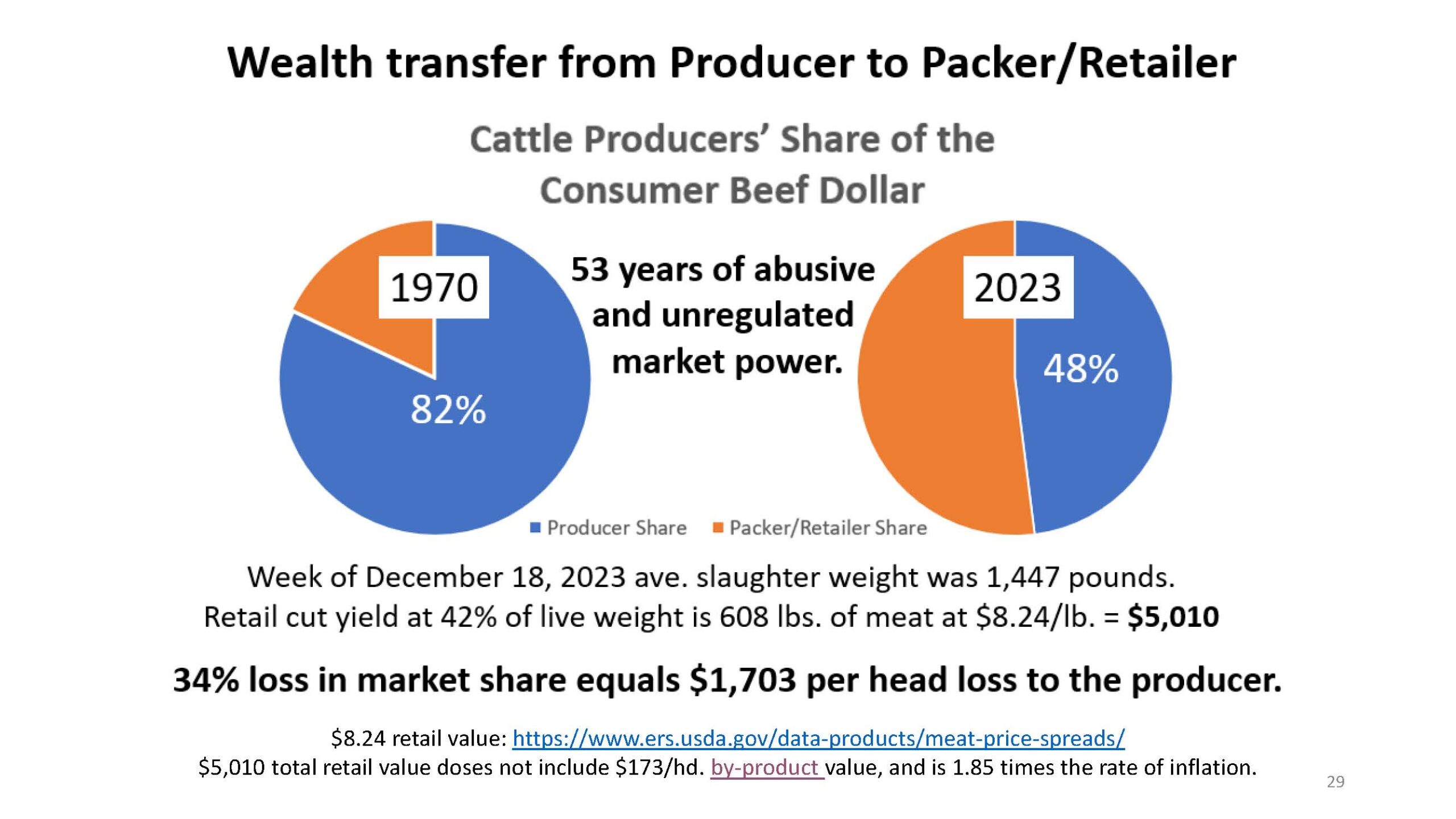

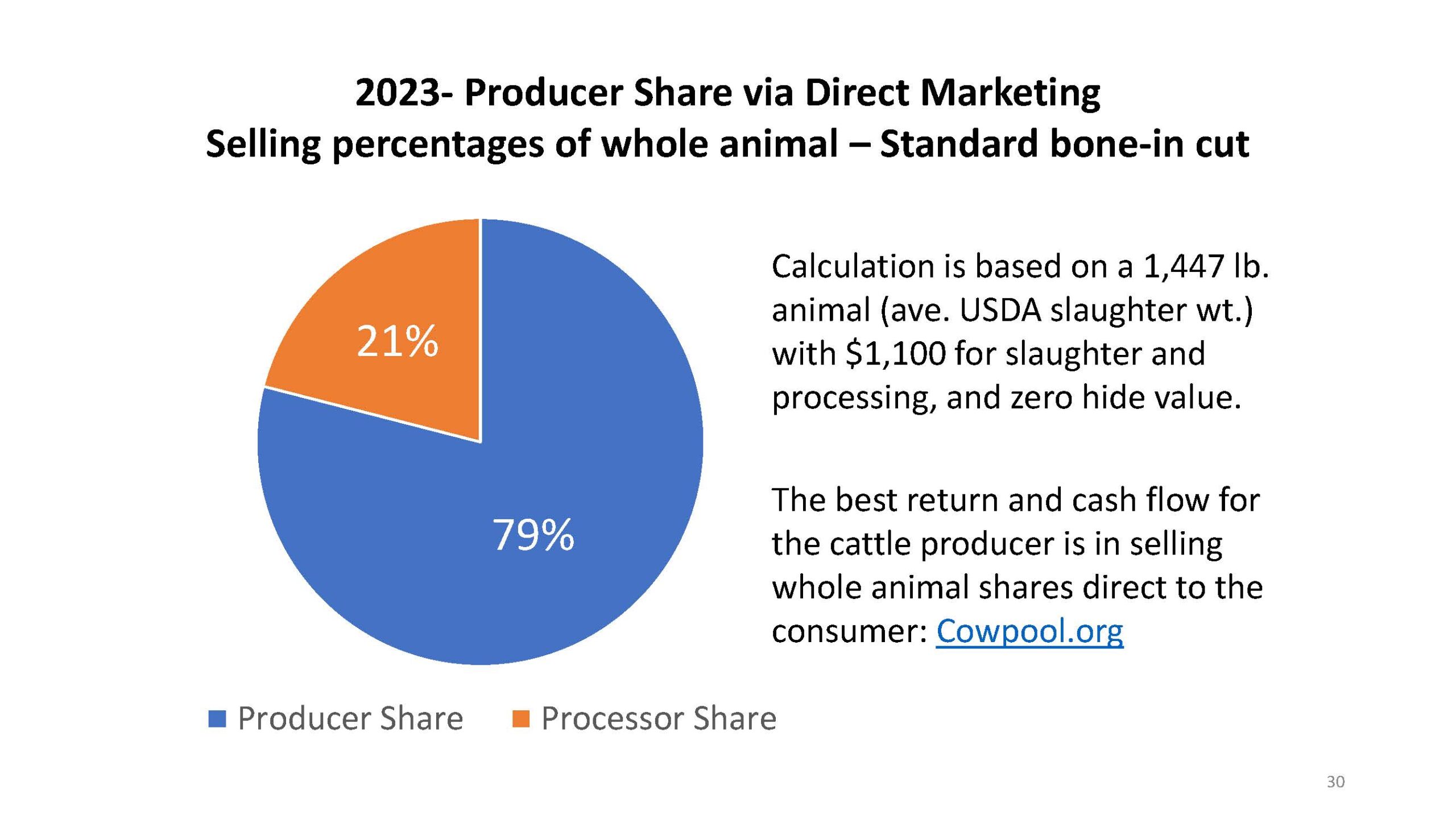

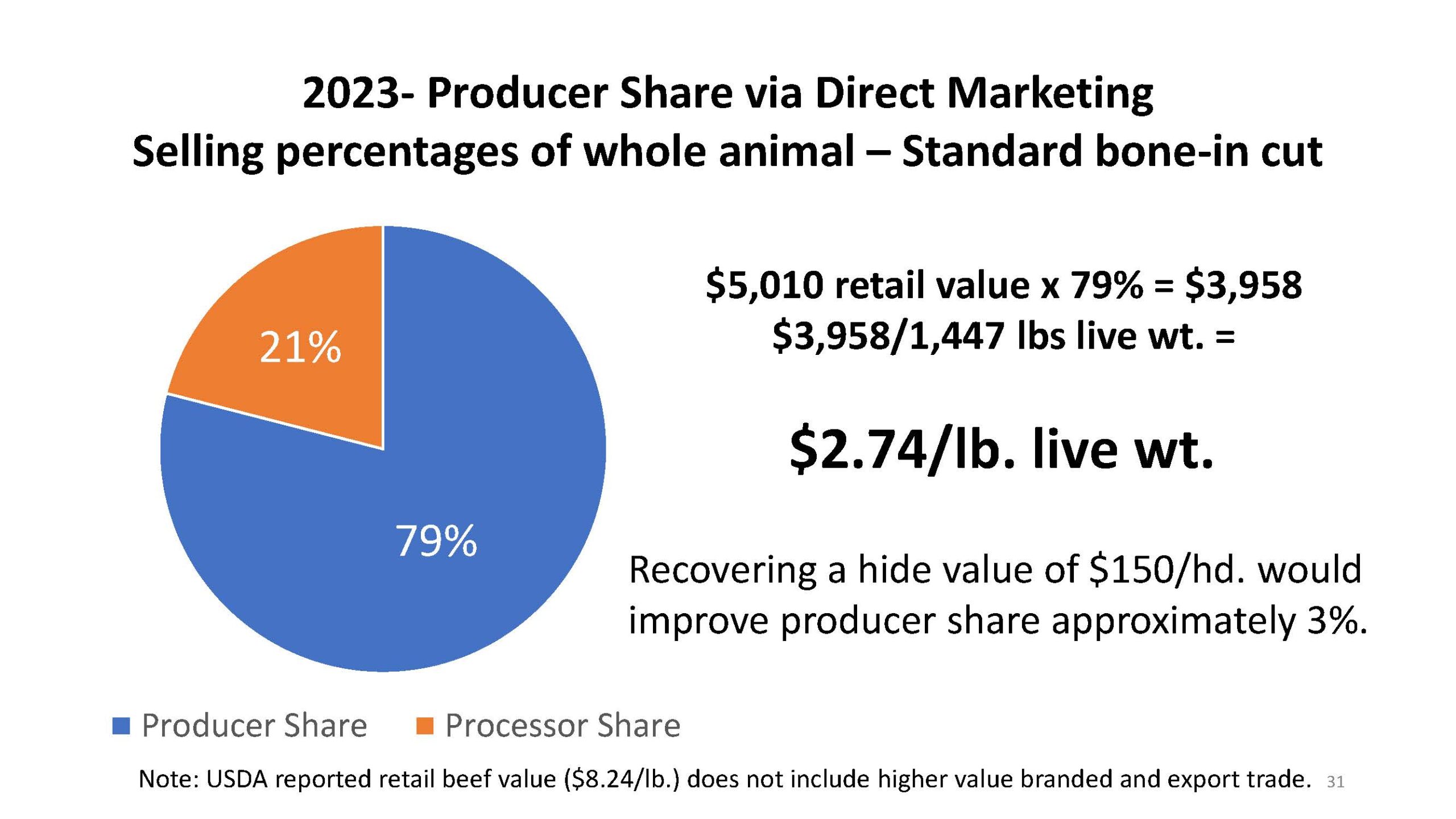

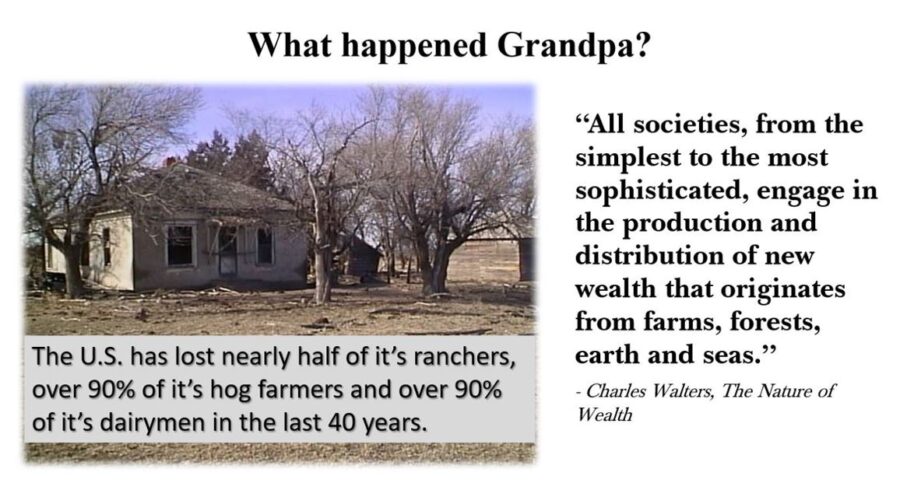

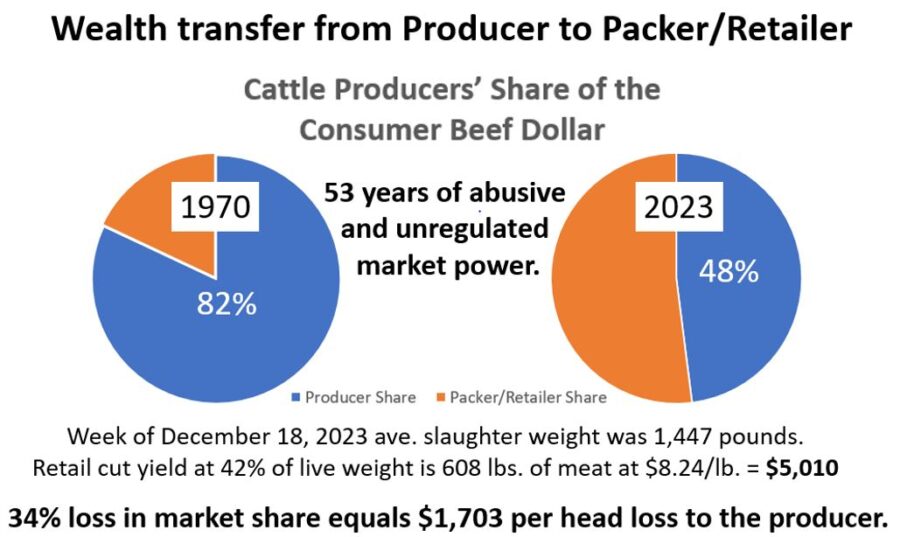

After more than 50 years of concentration, consolidation, hyper-industrialization, and a pandemic, the producers, workers, animals, and consumers have all suffered from the loss of competition and demise of local/regional food infrastructure. Land-grant and business school economists teaching “Big is better – It’s a business, not a way of life,” have facilitated the gutting of rural America with an increasing wealth transfer from the land and the people who do the work, to the financial sector.

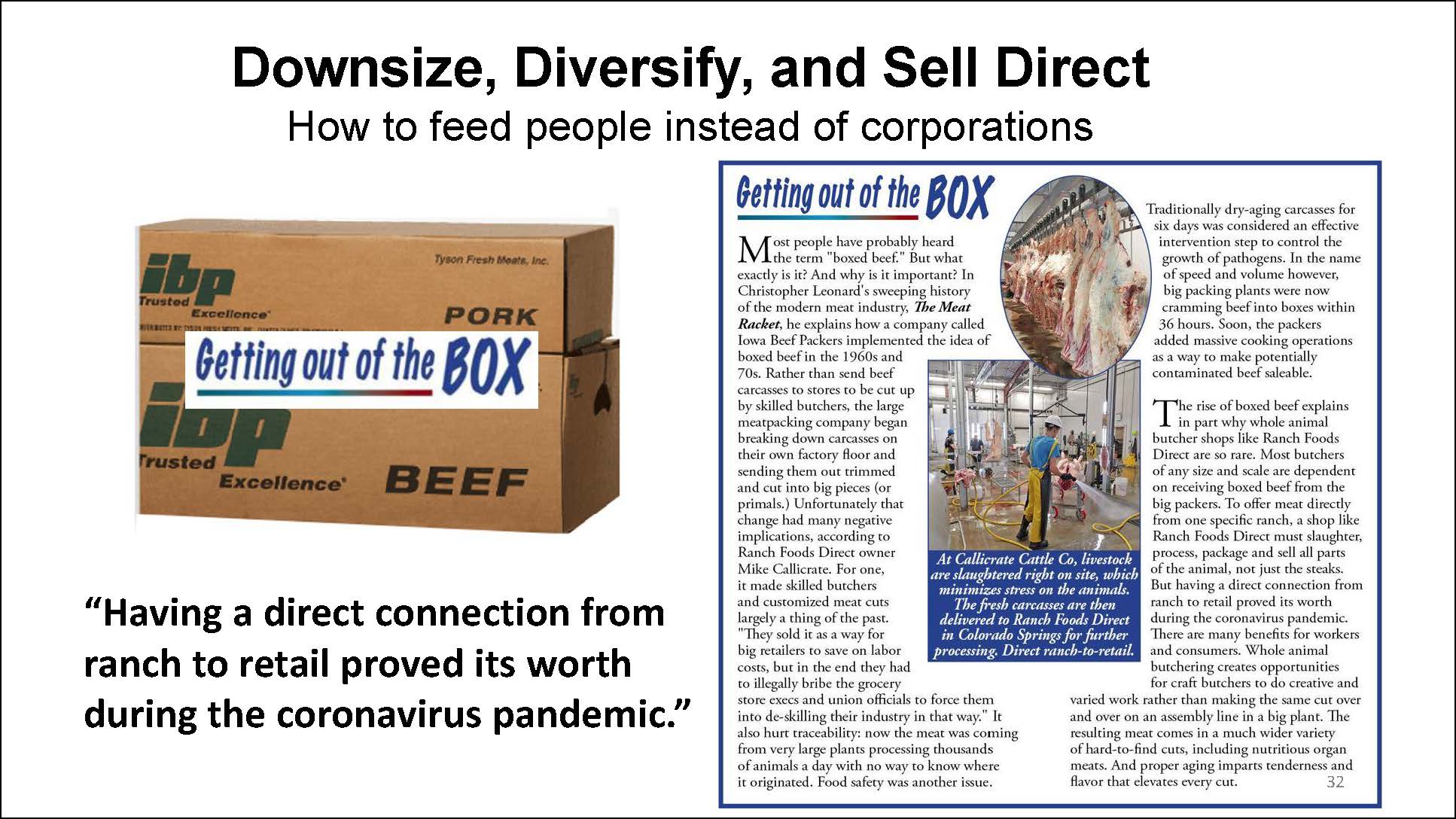

Getting put in the Box

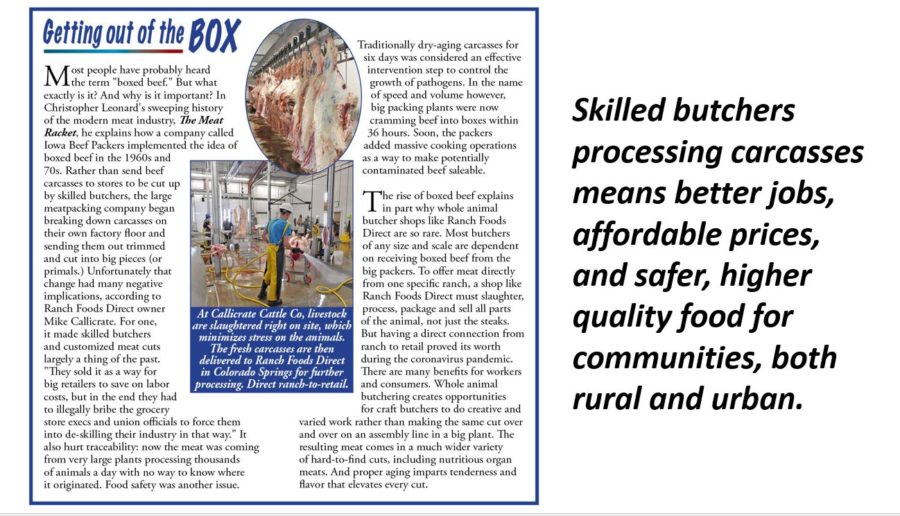

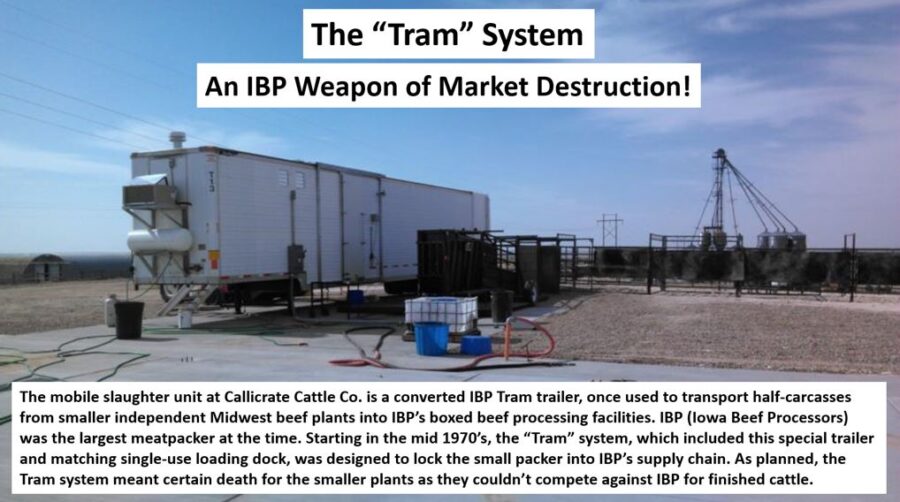

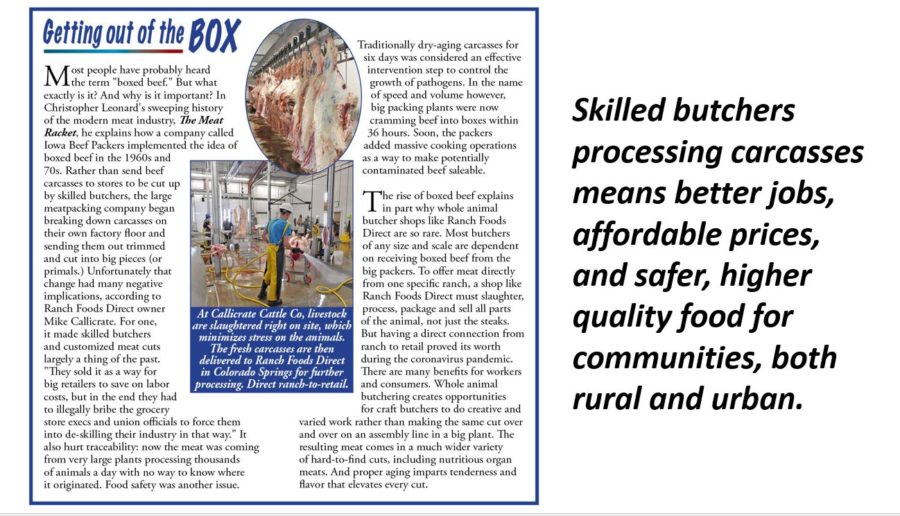

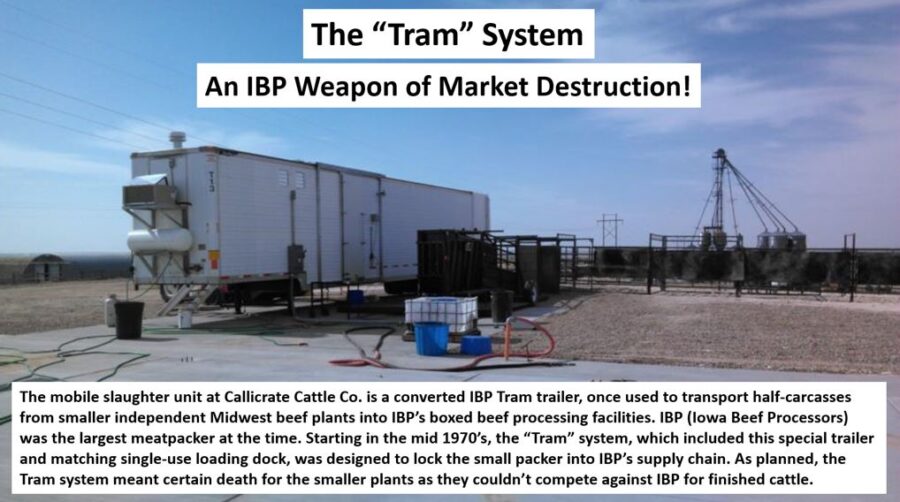

When I started feeding cattle in the mid 1970s, there were twenty-some small to regional meatpackers buying cattle in my area and selling carcasses to grocery stores with fresh meat counters and butcher shops. Meat cutters, breaking the carcasses down into retail cuts in front of customers, were highly skilled and well-paid, with wages high enough to drive new pickups and live in homes they would own when the mortgage was paid. By the mid 1980s, the small meatpackers and skilled butchers, from slaughter to retail, were mostly gone, along with my pathway to a fair cattle market. What happened?

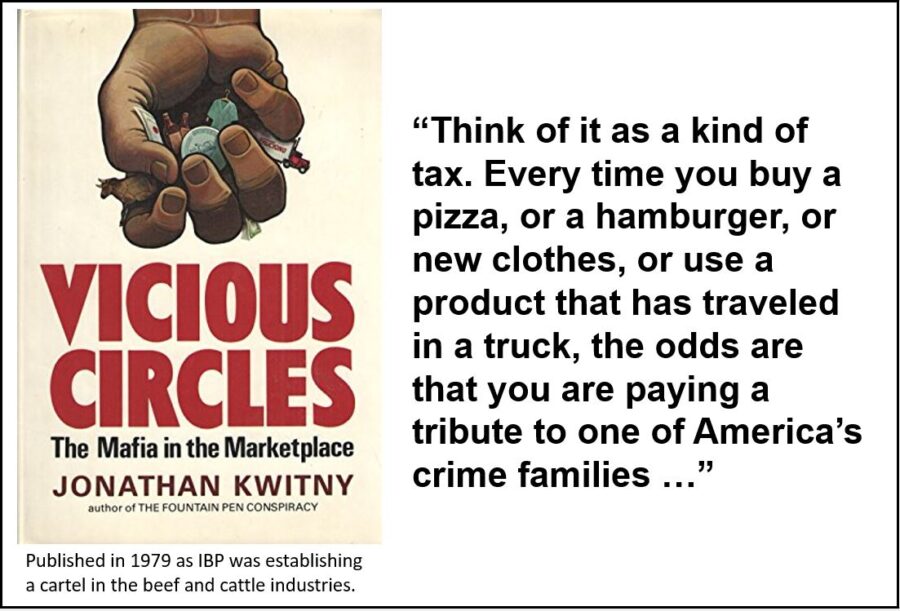

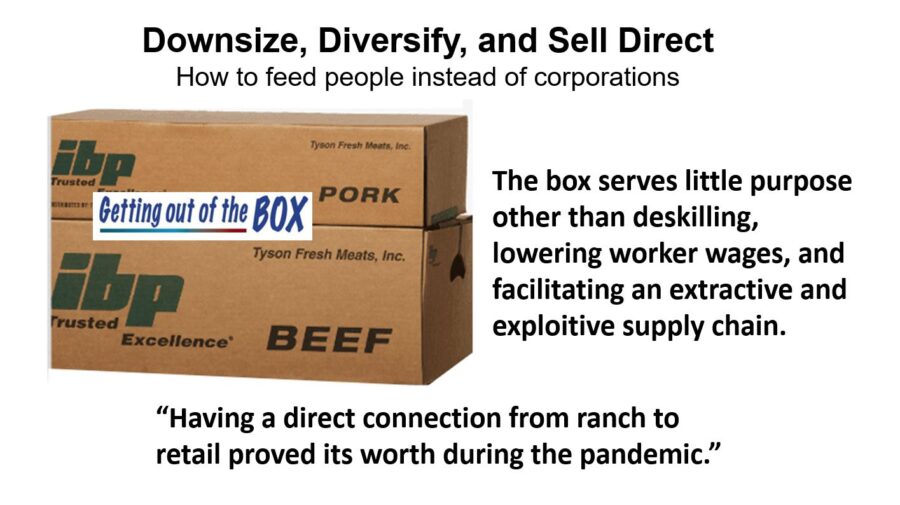

Think of boxed-beef, the “Box,” as a tool, a tool of extraction, like a mafia bag man standing between the rancher and the consumer demanding a larger and larger share of the wealth created from the land. Few knew at the time IBP (Iowa Beef Processors) implemented their boxed-beef program in the late 1960s how much the “Box” would change an industry – and not for the better.

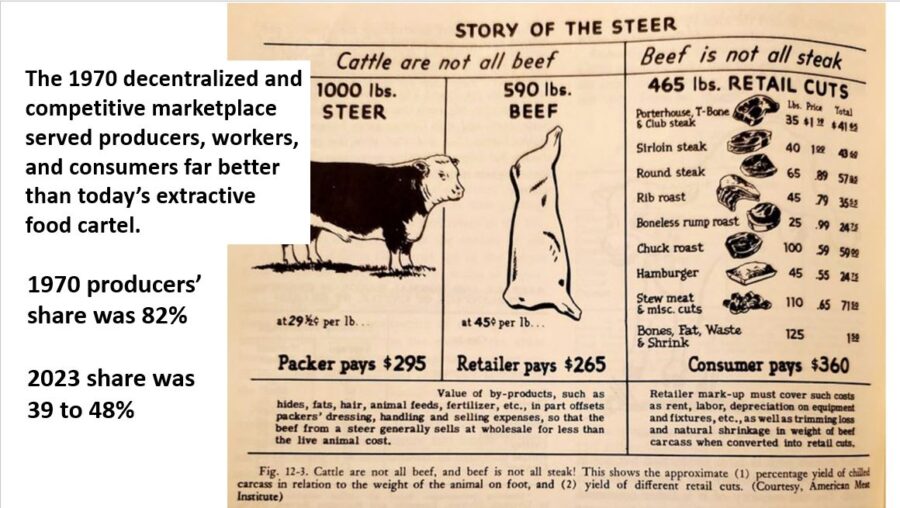

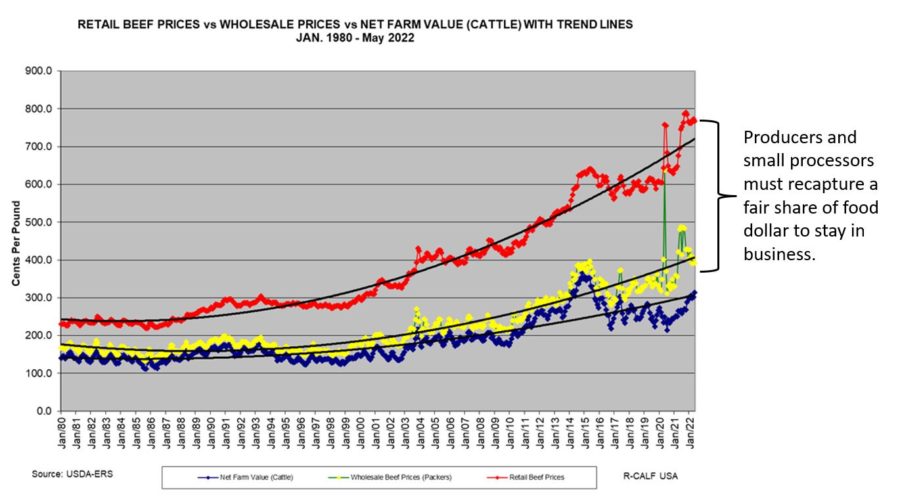

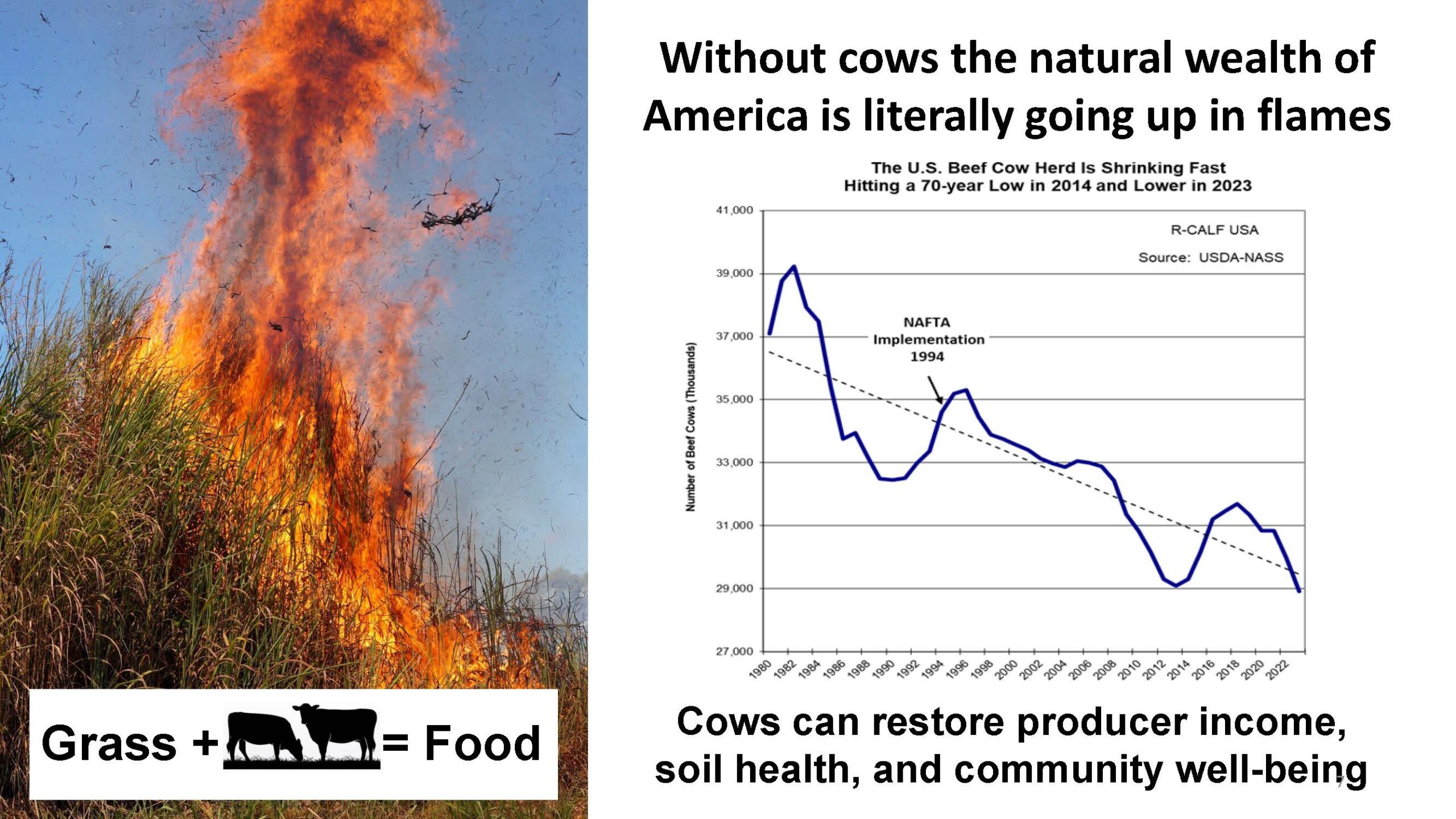

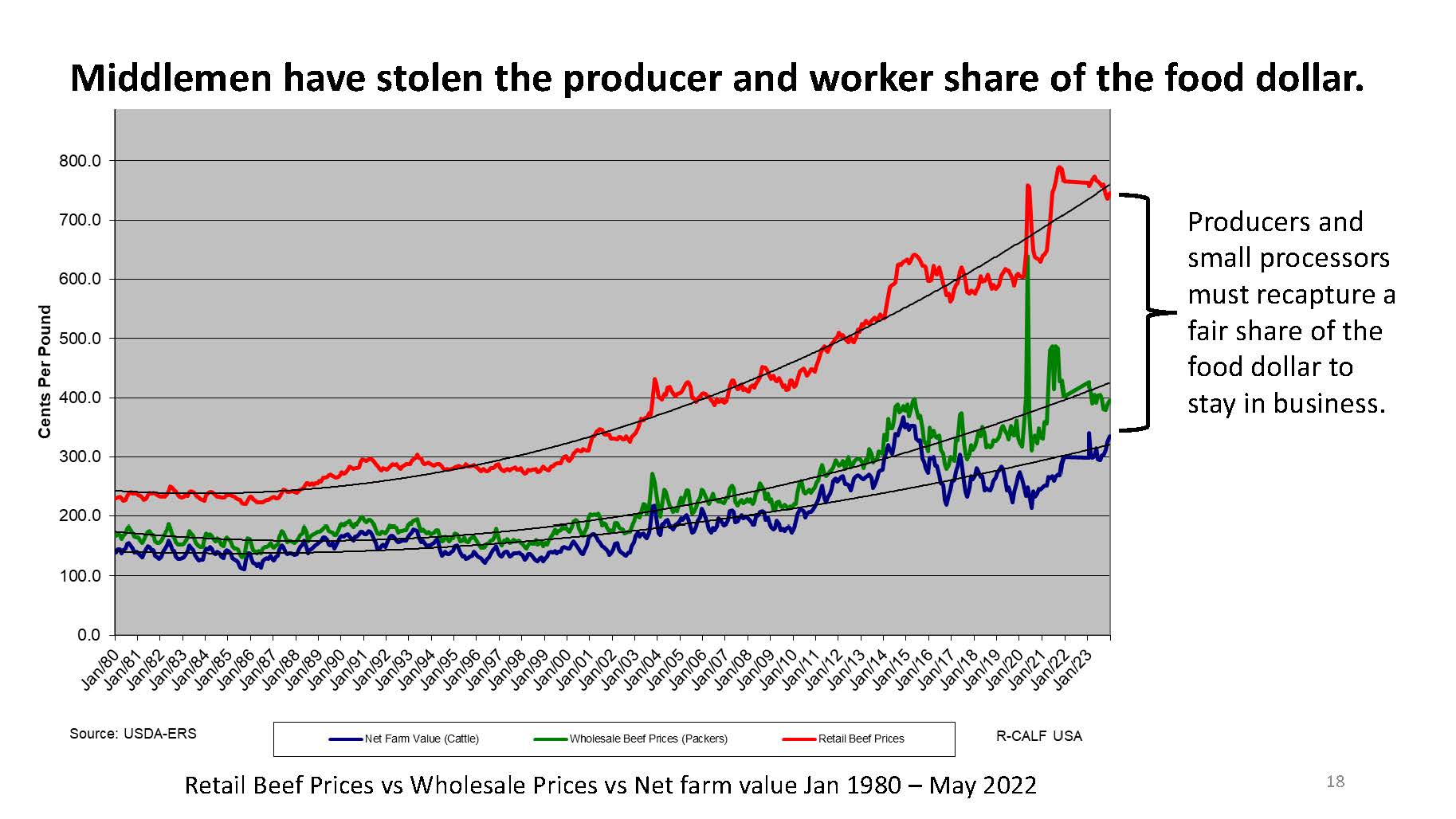

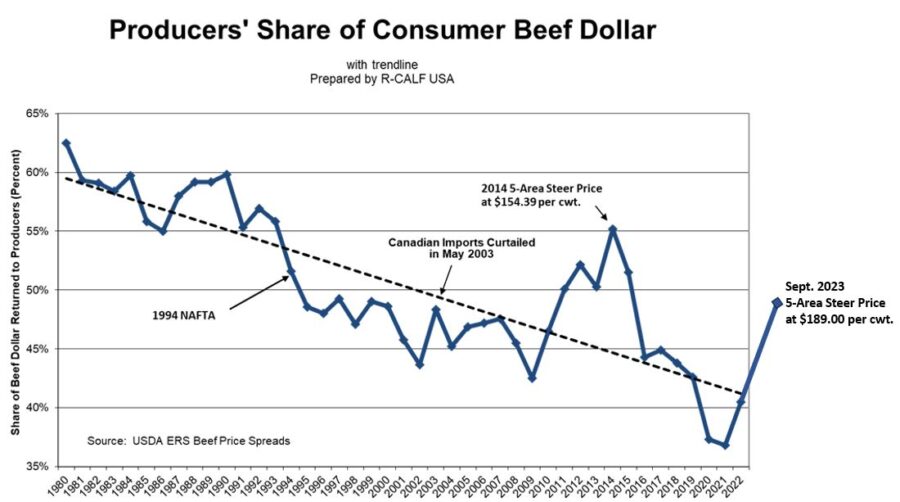

Cow-calf producers are the largest and most important sector in our cattle and beef industries, but as widely dispersed and independent operators, are no match for the concentrated market power of the food cartel: big meatpacking, big food retail, and big food service companies. Cattlemen are literally left with a few scraps after the cartel extracts their double digit returns. Despite the fact the rancher invests the most, and stands the most risk in producing our food, they’re often left eating their equity, without enough income to feed themselves or support their families.

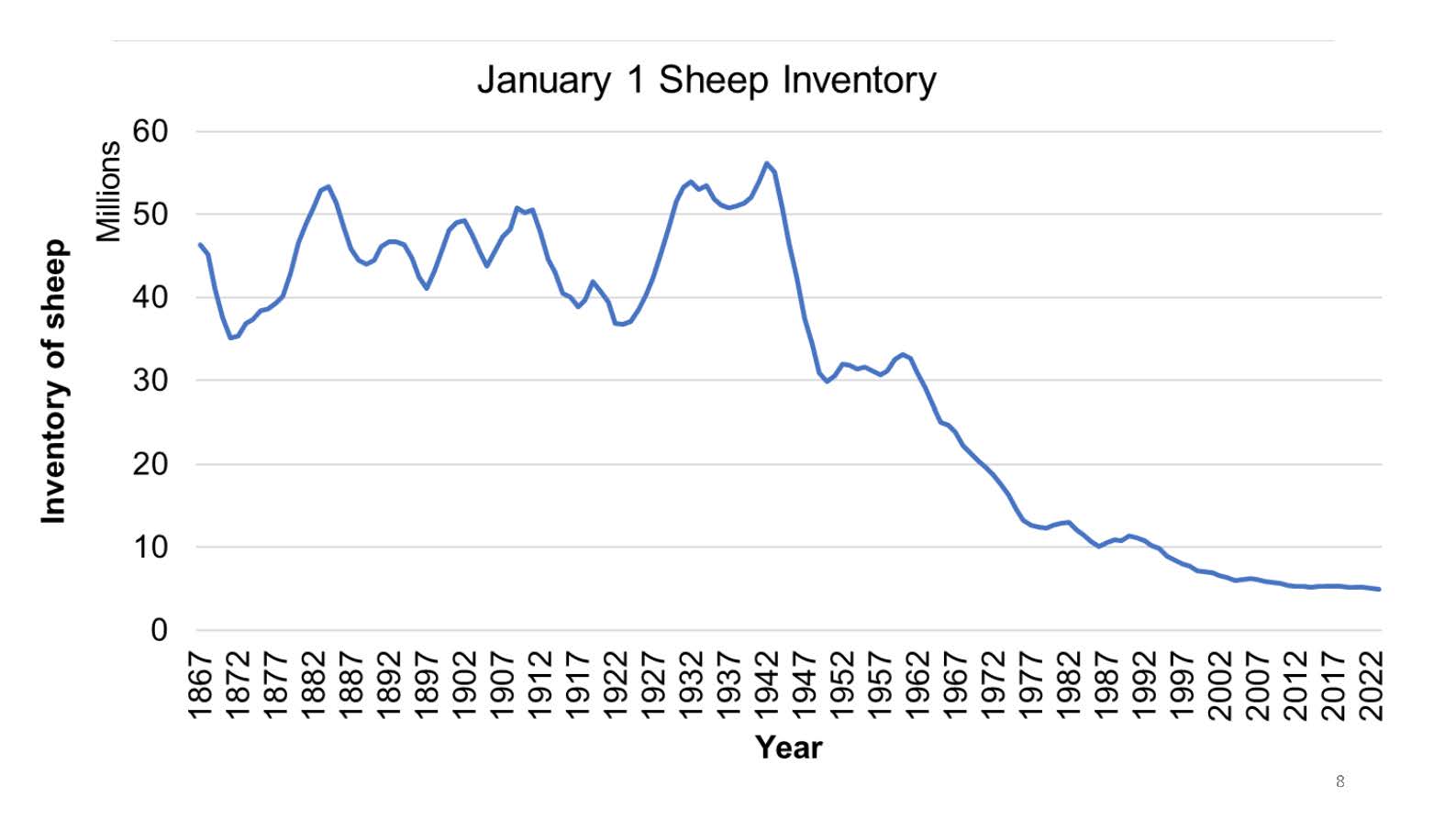

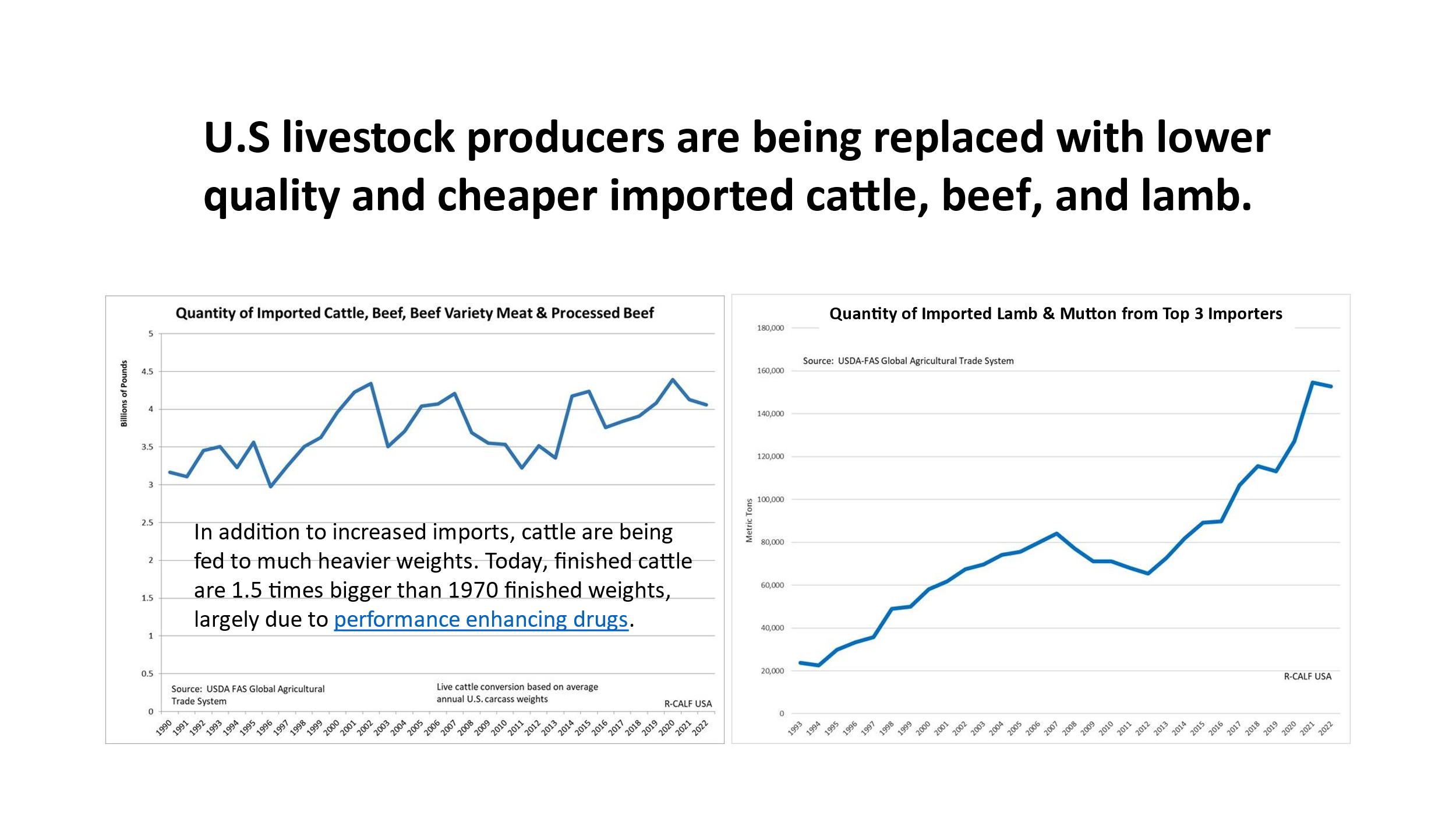

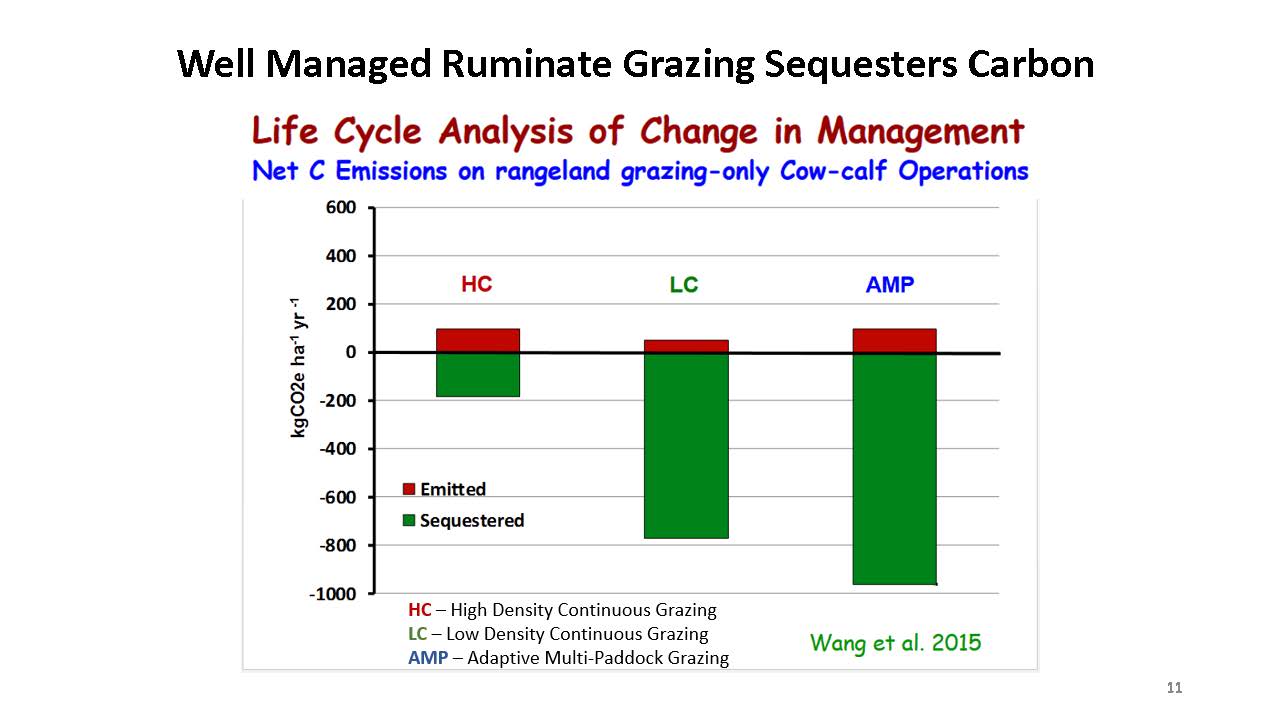

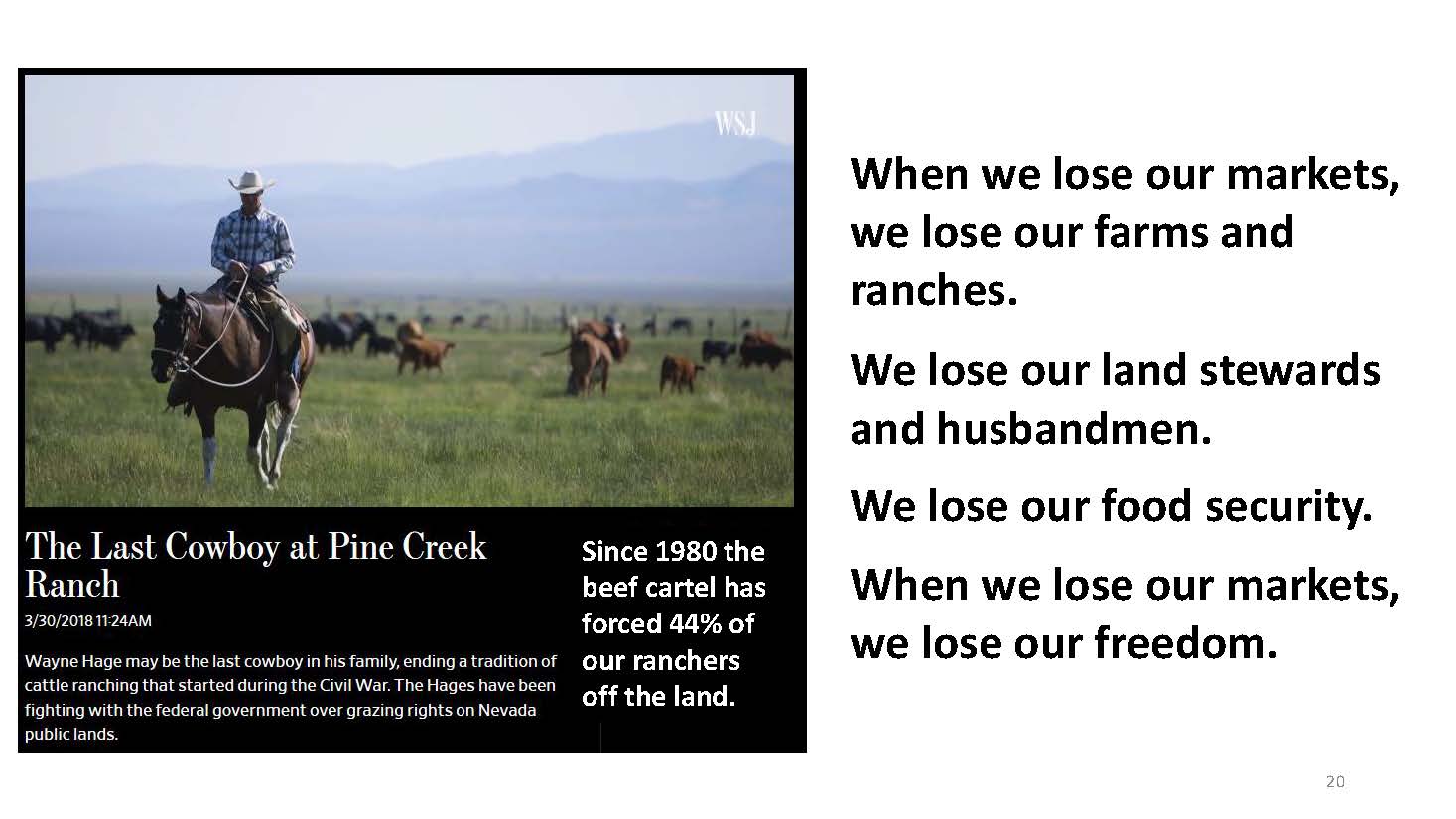

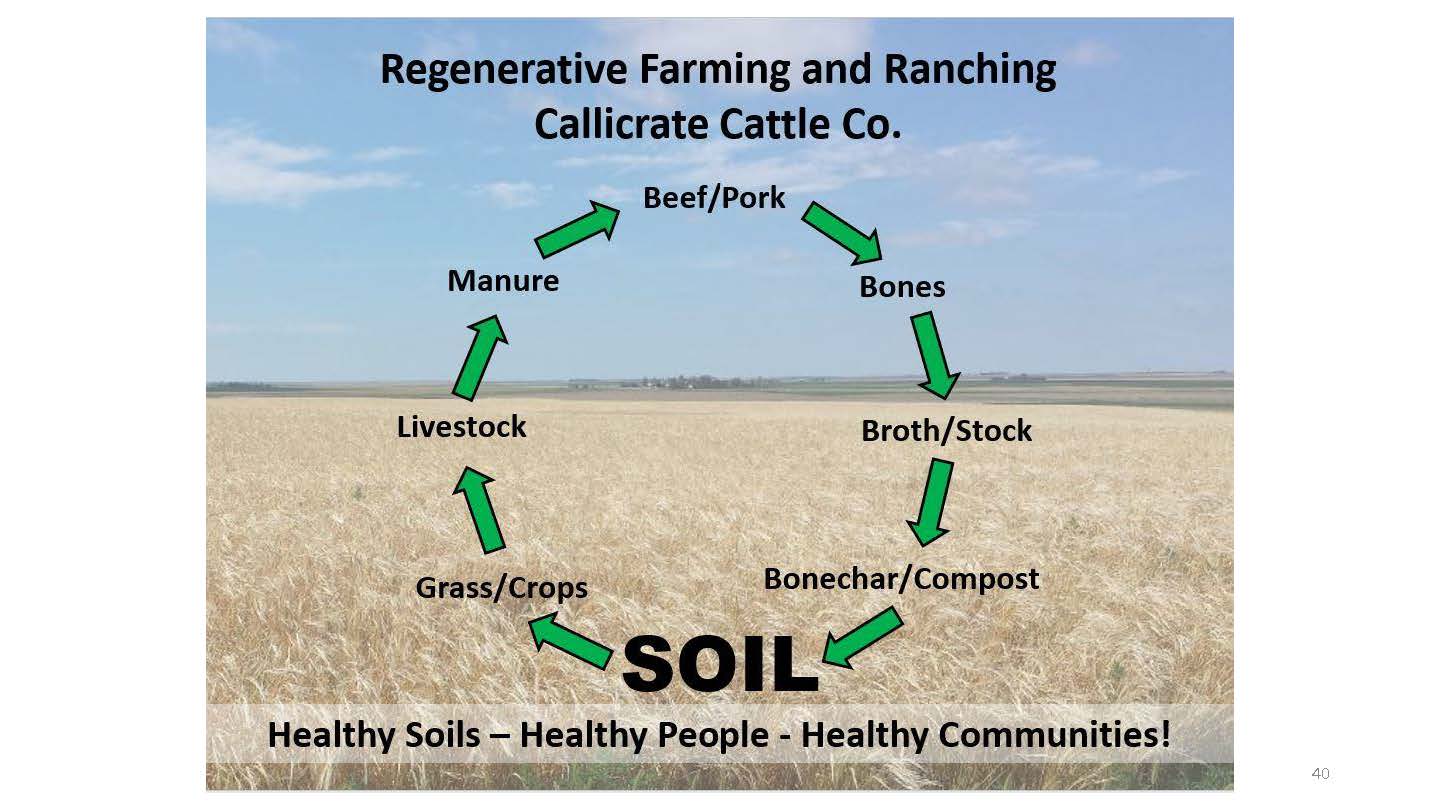

The “Box” is the primary tool today’s meat cartel uses to mine even greater amounts of wealth from our farms and ranches than the robber baron meatpackers of the early 1900s. Turning grass into beef is the cows greatest gift, so why are we allowing the beef cartel to continue driving our ranchers and farmer feeders out of business, reducing our ability to feed ourselves, replacing our producers with low quality beef imports, while removing more soil building, climate healing cows and other ruminate animals from the landscape?

Click on image to expand

How we were put in the box …

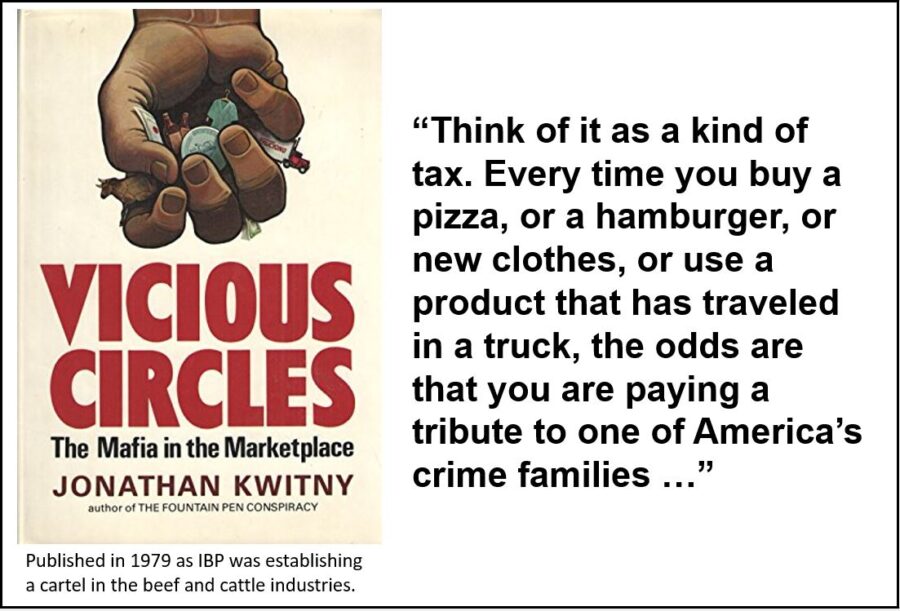

In 1970, the New York meat trade rejected IBP’s new innovation in boxed beef in favor of their long established and successful carcass trade. The meat cutters union, protecting the interests of their skilled and well-paid butchers, also said no to boxed-beef, leaving IBP with millions in unpaid invoices, and in deep financial trouble. In the panic, the solution became clear – bribery.

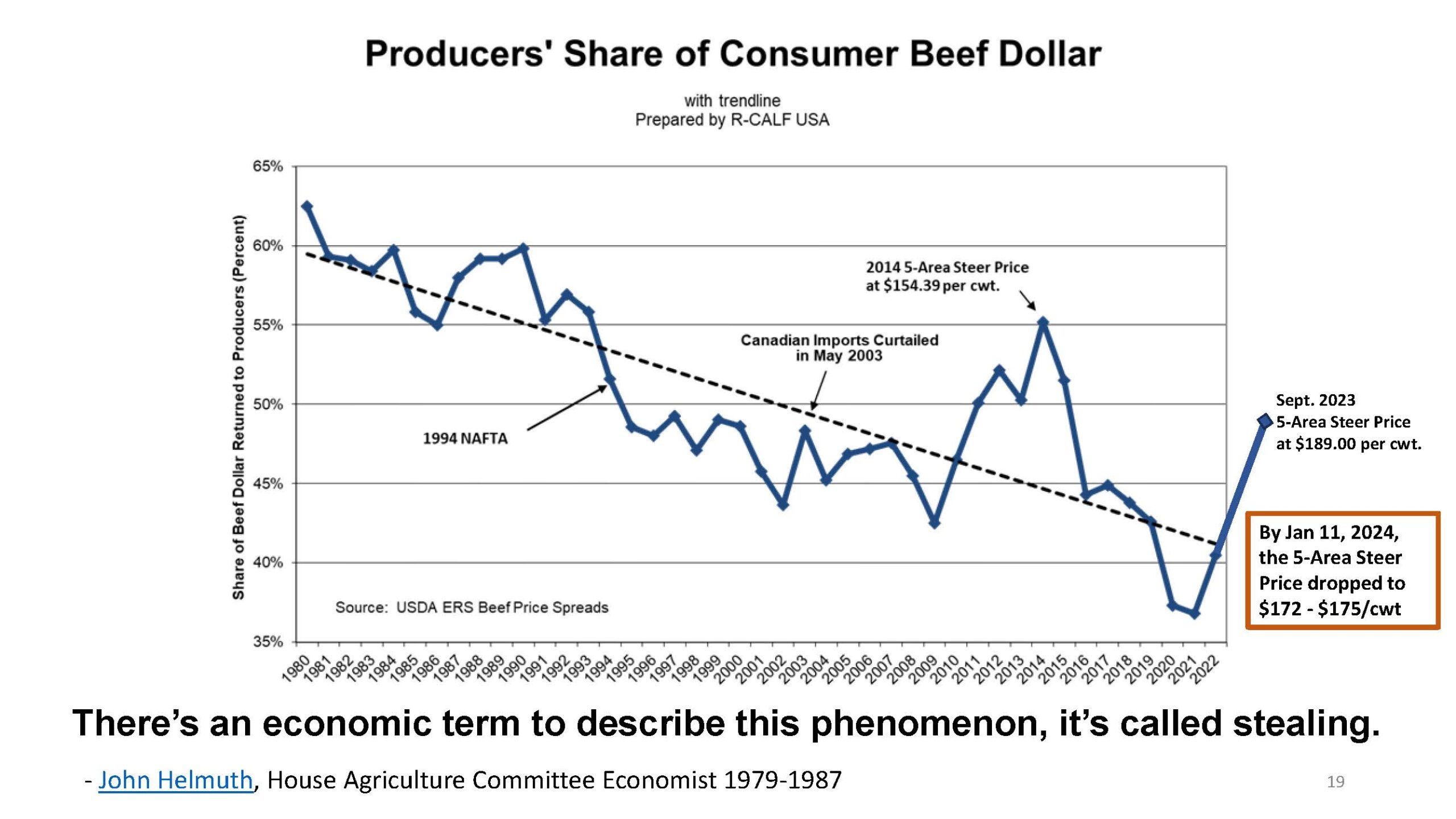

The deal put IBP in command of the beef world. With the Mafia partnership and the eastern meat trade in hand, IBP became the biggest beef packer in in the world, and soon aligned with the other two biggest beef packers, Cargill and Monfort (later became ConAgra, now JBS) to manage the market in their favor and hyper industrialize the supply chain. In violation of every provision of Section 202 of the Packers and Stockyards Act, the three predators, like a T-Rex and two Raptors, proceeded to consume essentially all of the smaller owner-operated, more efficient, and lower cost carcass plants. With antitrust cops and trial court judges in the pocket, or looking the other way, the cartel drove four-firm concentration to 85% and competition to near zero. With retail consolidation tracking the same as meatpacking, the cow-calf producer, the course of least resistance, has paid the bill with a drastically shrunken share of the consumer beef dollar.

“But on this day, Moe Steinman, as a front for the Mafia, would achieve what no one else had achieved, even in the days of Al Capone or Lucky Luciano. Moe Steinman, who had risen from the gutter only by his lack of scruples, would tighten his fist around one of the biggest corporations in the country, a corporation that dominated a major national industry. It was an industry that almost every American depended on almost every day. It was an industry – unlike trucking – that was clothed with all the garments of Wall Street respectability.”

The markets worked prior to IBP’s boxed-beef deal with the Meat Mafia:

Buy your beef from a carcass butcher and make sure it hangs for at least 7 days.

Getting out of the box is the key to restoring widespread economic prosperity, improving food system resilience, food safety, food security, and meat quality.

See: Vicious Circles – Big meat packers continue to suck the blood out of cattle industry

Deskilling on the Disassembly Line: Technological Change and Its Consequences in Beef-Packing Since the 1960s

Food System Success or Failure? It’s time to decide

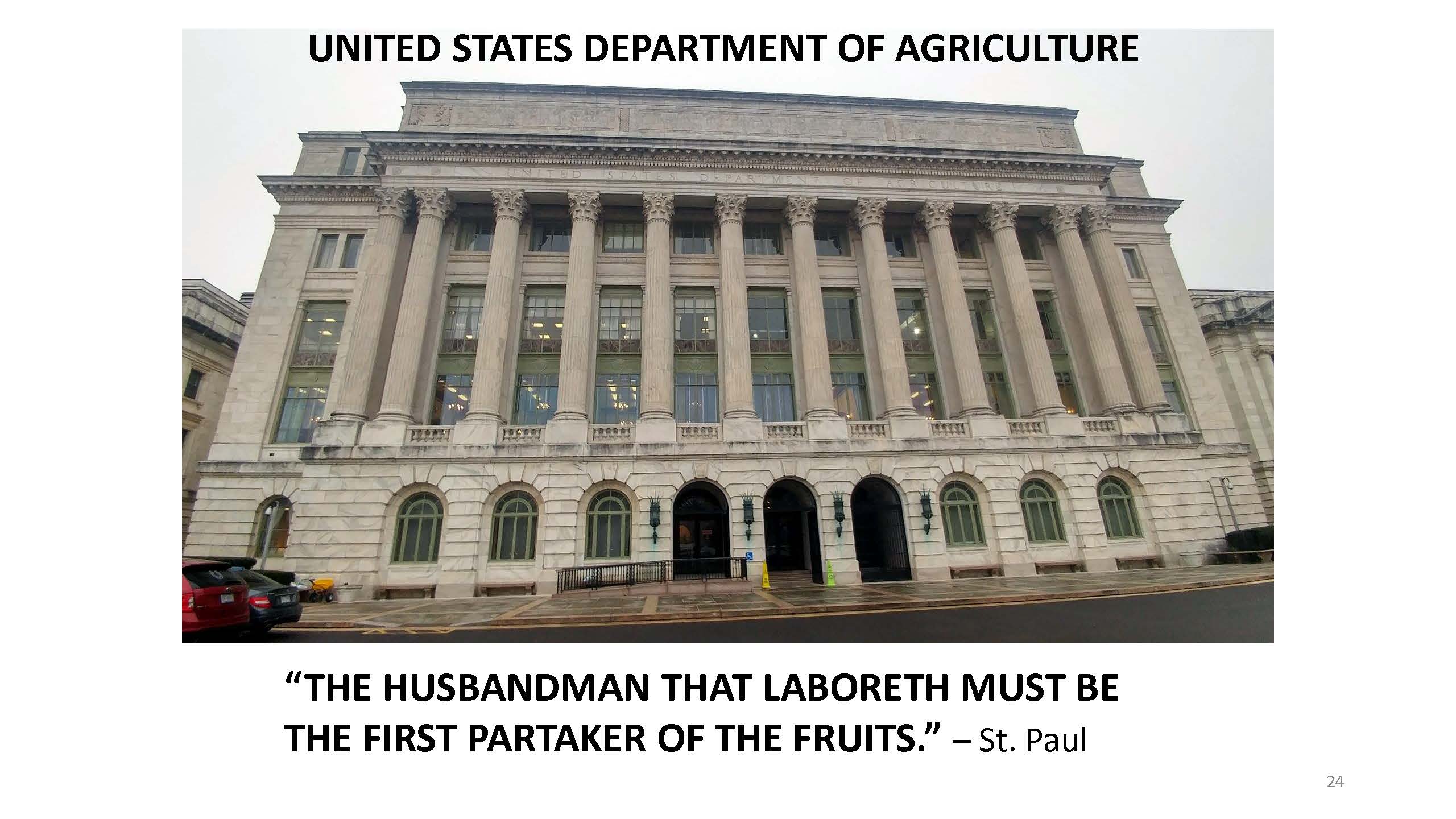

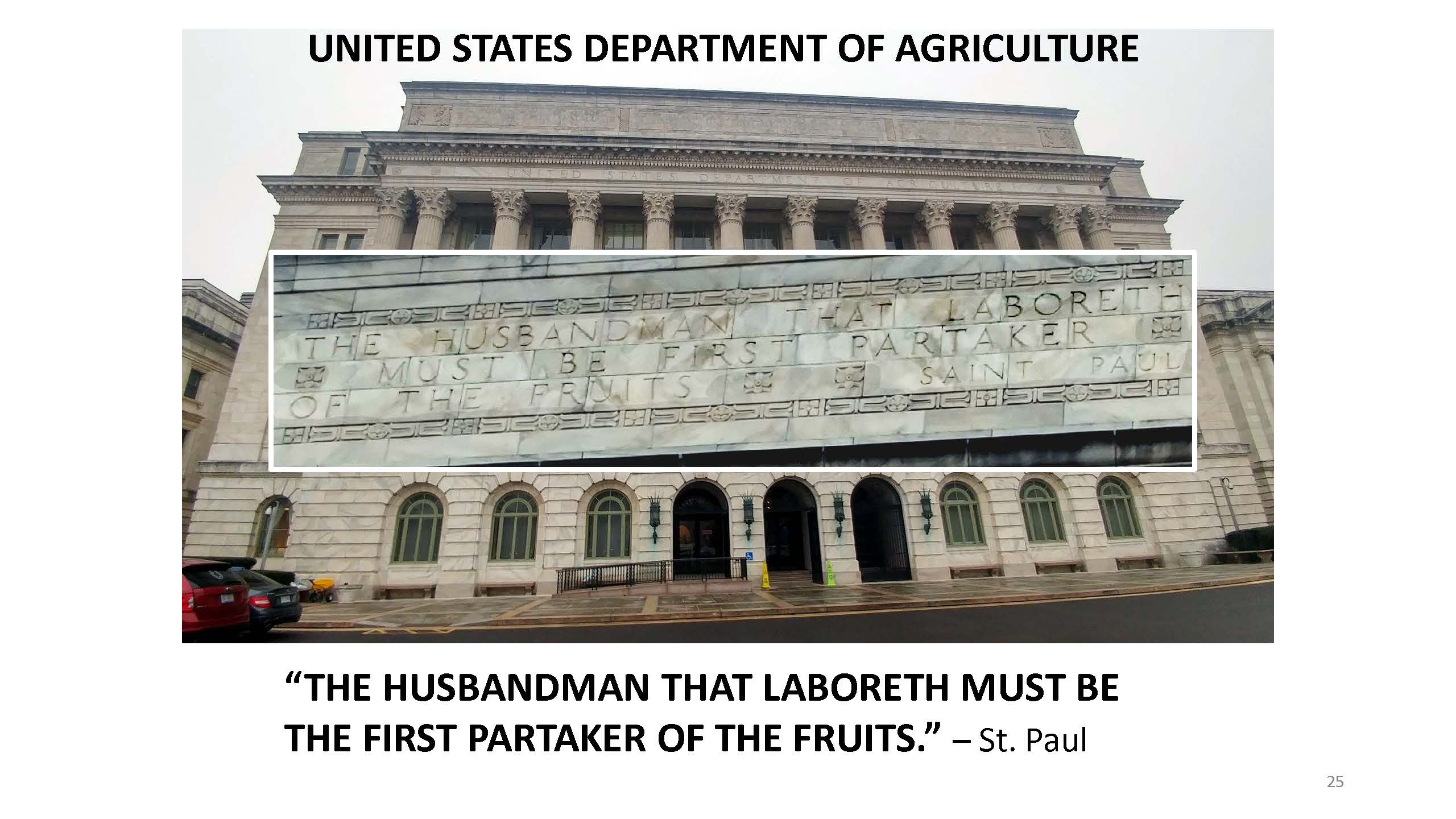

The Secret at 1400 Independence Avenue

How We Got Here … The food security crisis in America

What could 300 million dollars do? Part II

There’s an economic term to describe this phenomenon, it’s called stealing.

There’s an economic term to describe this phenomenon, it’s called stealing. $8.24 retail value:

$8.24 retail value: