Gilles Stockton

The proposed merger of Krogers and Albertsons grocery chains cannot but result in fewer market choices and higher prices for consumers of beef, and therefore, decreased competitiveness in the cattle market. Krogers is the second largest supermarket chain in America, while Albersons sits at number four. Walmart is number one and Costco number three. Together these four chains sell 45% of the food bought by the American consumer. If the merger goes forward, only three companies will control nearly half of the food market, which of course includes half of the beef.

Krogers and Albertsons own dozens of other brand name stores between them so you may be buying from them without knowing so. For instance, Krogers owns Fred Meyers and Harris Teeter while Albertsons owns Safeway, Buttreys, and ACME. This Kroger/Albertsons merger might seem remote from our daily ranching duties but inevitably it will have a negative effect on the price of feeder calves.

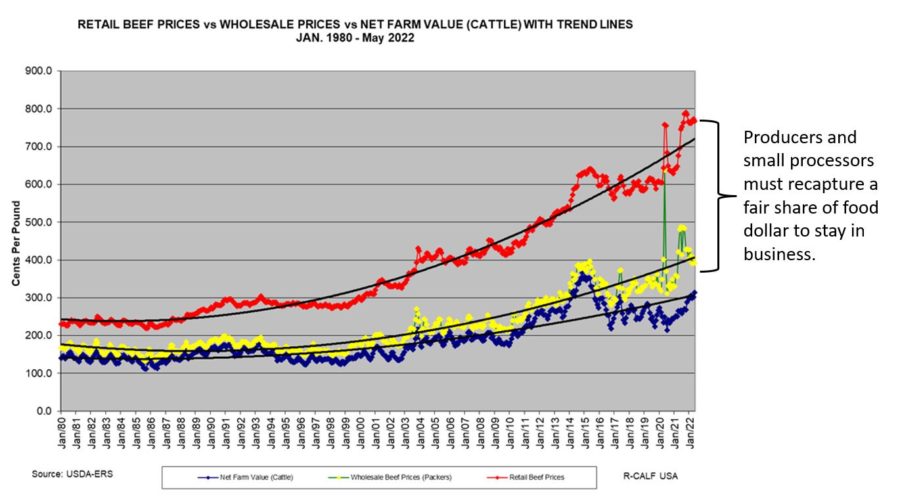

The farm to retail spread has not been going in our favor for a long time. Over the last fifty years, the producer’s share has been cut in half from 71.3% to 36.5%. This is also the time period where the four largest packers went from controlling 26% of the market to 85%. Most of the retail spread redistribution resulted in increased profits for the retailers although the packers have also taken their cut.

It’s easier to buy cattle cheaper than to sell meat higher to the meatpacker/retailer cartel, who are now in a battle for control and share of the consumer beef dollar.

When Congress rescinded Country of Origin Labeling in 2015 something changed in the market dynamics. We ranchers experienced that change as a nearly 50% cut in the price of feeder calves, but retailers also began losing ground to the packers. According to research from Iowa State University (Multi-plant Coordination in the US Beef Packing Industry. C Pudenz and L Schulz, 2022) the packers have developed cattle purchasing algorithms that allows them to strategically coordinate the buying and slaughter of cattle across their multiple plants. This gives them a more efficient procurement capability but also gives us lower cattle prices.

The Iowa State paper does not speculate but we can assume that these same computerized algorithms allow each of the dominate packers to anticipate and coordinate with the purchasing behavior of their rivals. This capability must also extend to the selling of the beef. Hence, the pressure the retail sector is experiencing in procuring wholesale beef at the profit margin they have come to expect.

Part of the packer strategy has been to purchase fewer cattle on the spot market and, therefore, more through unpriced captive supplies (i.e. Alternative Marketing Arrangements or AMAs). Research from Georgetown University, (Buyer Power in the Beef Packing Industry: An Update on Research in Progress. N Miller et. all. 2022) shows that “a one percent increase in the AMA share of transactions is associated with a five percent decrease in the cash market prices.” With captive supplies approaching 80% it is no wonder that ranchers have been getting terrible prices and independent feeders are going out of business.

According to Dr. Robert Taylor (Harvested Cattle, Slaughtered Markets. 2022) we have lost 83,000 independent feedlots over the past 25 years with 48,000 of those just in the last ten. Meanwhile the number of feedlots with a capacity of over 50,000 head have increased from 45 to 77. Independent feeders have disappeared but the feeding capacity has stayed the same. The operating expenses of a small independent feedlot is essentially the same as that of a large. Costs of calves, feed, labor, management, and finance has to be close to identical over a wide range of feedlot sizes. Differences in economy of scale is not a convincing explanation for the loss of independent feeders.

Dr. Taylor asks that if feeding cattle has been unprofitable over the last 10 years, why is it only the independent feeders who go out of business while the large feedlots, with close ties to a packer thrives? One possible explanation is that what is being reported to USDA as the market value of a fed steer is not the true price paid. Vertically aligned feedlots are possibly getting an unreported premium or other nondisclosed advantages. Clearly the cattle industry is now rapidly experiencing vertical integration, much as the pork industry did in the 1990’s.

As mentioned, 2015 was the year that Congress rescinded COOL, thus allowing imported beef to masquerade as US product in the retail markets. Couple that with the ability of the packers to coordinate the buying of fat cattle through increased use of captive supplies and we have an explanation of why the cattle market collapsed by almost half with an inevitable result in the loss of independent feeders.

Vertical integration will probably not extend overtly into the cow/calf sector of the industry, but most certainly, our choices for buyers of feeder calves is being rapidly reduced. We are becoming a part of a vertically integrated captive supply chain without even knowing so.

As to the proposed merger of Krogers and Albertsons, that will not be to ours or the consumer’s, benefit. But there are other trends going on at the retail level that are also problematic. The dominant retailers are developing their own vertically integrated supply chains. Costco has invested in egg and broiler production. Walmart has created a dedicated supply chain for Certified Angus Beef. On the surface this may appear to be an additional market channel, but do cattle producers or for that matter, consumers, actually benefit?

The Kroger/Albertson merger is not a done deal. It still needs approval by the Federal Trade Commission and the Department of Justice. There is a chance it will not be approved but this is a small chance because virtually all mergers over the past forty years have been allowed. Even mergers that blatantly do not benefit the consuming public.

As for the Walmart owned Certified Angus Beef subsidiary, that should also be illegal under the Packers and Stockyards Act which clearly states that a packer cannot favor one buyer over another in the selling of beef. If the packer is owned by the retailer, this is a conflict of interest and, therefore, a violation. Of course, the Packers and Stockyards Act, along with the other antitrust laws, has been ignored over the last forty years, which explains the mess that this country is in. We can ask, if Walmart owns their supply chain for beef wouldn’t the next logical step be for Costco and Krogers to buy JBS and Tyson?

These are complex issues threatening the cow/calf rancher’s financial viability and independence. We cow/calf producers tend to take our public market for calves for granted. Chickens and hogs used to be sold in a public market forum – but no longer. The publicly reported spot market for fed cattle is already almost non-existent. It can’t be long before the public market for feeder calves is also made to disappear.

These are all threats to our markets and independence. We need to oppose the is Kroger/Albertson merger and challenge the legality of the Walmart investment in Certified Angus Beef. We also need to continue the fight to restore Country of Origin Labeling and demand a rule from USDA that requires packers to buy fed cattle in a competitive market – no more captive supplies. If producers don’t come together to protect our industry from vertical integration, then we might as well pack it up and get used to being a serf on our own land.

Gilles Stockton

Grass Range, Montana

The Tyson fire and COVID gave the upper hand, along with unfair margins, back to the big packers at the expense of the retailers. Instead of the retailers robbing the bank and the packers driving the getaway car, it was reversed. The big retailers, having grown accustomed to unfair margins, are pissed and they are acting. Walmart is going deeper down the beef supply chain to a more vertically controlled market like poultry. The failure of the Pickett/IBP/Tyson lawsuit, COOL, Mandatory Price Reporting, etc., have all given the green light to the big food cartel to proceed in pillaging the cattle producer, and worse than chicken farming serfdom – the cowboys are building Walmart’s slaughter house.

The North Platte Sustainable Beef group building a packing plant for Walmart (The Walton’s are the richest family in America and the largest food retailer.) takes vertical integration to a new level of control and producer self-enslavement.

Given these anti-competitive supply chain developments, Kroger and Albertsons are just trying to keep up with Walmart. There is no way to compete in today’s dereg, biggest cheater wins, monopoly controlled economy.

Considering consumers, the merger talk includes plans to close hundreds of stores. Colorado is dominated by Kroger and Albertsons/Safeway. Think how many food deserts will be created.

I remember a few years ago when Albertsons was in financial trouble and a private equity group stepped in and bought the chain, only to then buy close competitor Safeway. If approved, the buyout will be a boon to the private equity owners and devastating loss for cattlemen and consumers.

Just keeps getting worse for the consumer, doesnt it? Proces alone have caused a lot of working folks to quit buying beef. I buy what little beef I eat, right across the street at Mikes little outlet in St Francis Still the best beef on the market at any price….Keep the pressure up MIke..!