As we continue to discuss ways to restore competition, let us not forget who we are dealing with. ConAgra, an abusive multinational conglomerate, later sold to Brazilian owned criminal conglomerate, JBS. IBP, the biggest beef packer in the world, sold to chicken giant, Tyson.

The food cartels left controlling our food system, from baby formula to school lunch, are serial offenders and must be broken up before any new local/regional food infrastructure can have a chance of succeeding . No compromises.

Big packers are gangsters, thugs, and thieves

Link to the JBS Violation Tracker

Listen to Ranching Reboot episode #66 – Building a Food Village

Corporate Roundup

February 1998

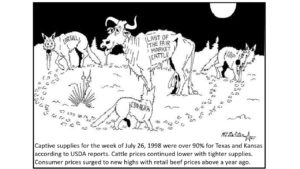

In a move that made cattle feeders livid and has drawn attention from government regulators, ConAgra sold cattle to IBP for slaughter in late January. ConAgra (and IBP) pushed cattle prices down with the deal, and left cattle feeders wondering if a competitive market — or laws against market manipulation — were still in force.

Here’s how market analyst Les Messinger described it: “We saw last week begin with packers bidding $63.00 while producers asked $66.00. As usual, record supplies of formula and contract cattle played a major role in allowing the packer to sit out the open market for the first three days of last week. Last Wednesday morning did succeed in bringing an additional new wrinkle into the market. After almost no open trade, it became rumored that IBP managed to get several thousand cattle bought at the lower price [i.e. $63.00]. Later that day it was disclosed that the party that sold those cattle to IBP was Monfort.” Monfort is ConAgra’s cattle-feeding and meatpacking subsidiary.

“Now let us see,” continued Messinger. “After being unable to buy cattle at the lower price, we see the world’s second largest packer selling cattle to the world’s largest packer. Hmmm! This was followed the next day by Monfort announcing that due to a lack of profitability they were shutting down three of their four plants on Friday, Saturday, and Monday.”

Other market-watchers reported that Monfort replaced many of the cattle it sold to IBP, for less than it got for the cattle it sold. That means Monfort made money trading cattle, by buying cattle after it drove down the market price by selling to IBP. And it drove down its costs for buying cattle to keep its slaughter plants full, too.

Concerns about packers’ use of this kind of practice to manipulate the price of cattle has prompted cattle producers to demand stricter enforcement of the Packers and Stockyards Act, the antitrust law which governs the meatpacking industry. Officials in the Grain Inspection, Packers and Stockyards Administration (GIPSA), part of the United States Department of Agriculture, are investigating.

Monfort did shut down three of its four packing plants for three days in late January and early February. Neither ConAgra or Monfort explained the shutdown, but livestock market analysts have been claiming that packers are losing money at current cattle and beef prices.

For its most recently completed quarter, ConAgra reported net earnings of $210.6 million on $6.4 billion in revenues—a 12% increase in earnings on sales that were 3% lower compared to its year-ago figures. The company reported 6% lower profits in its meat and poultry segment for the quarter compared to a year ago.