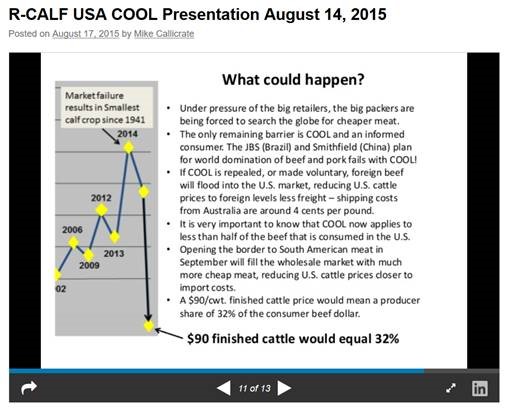

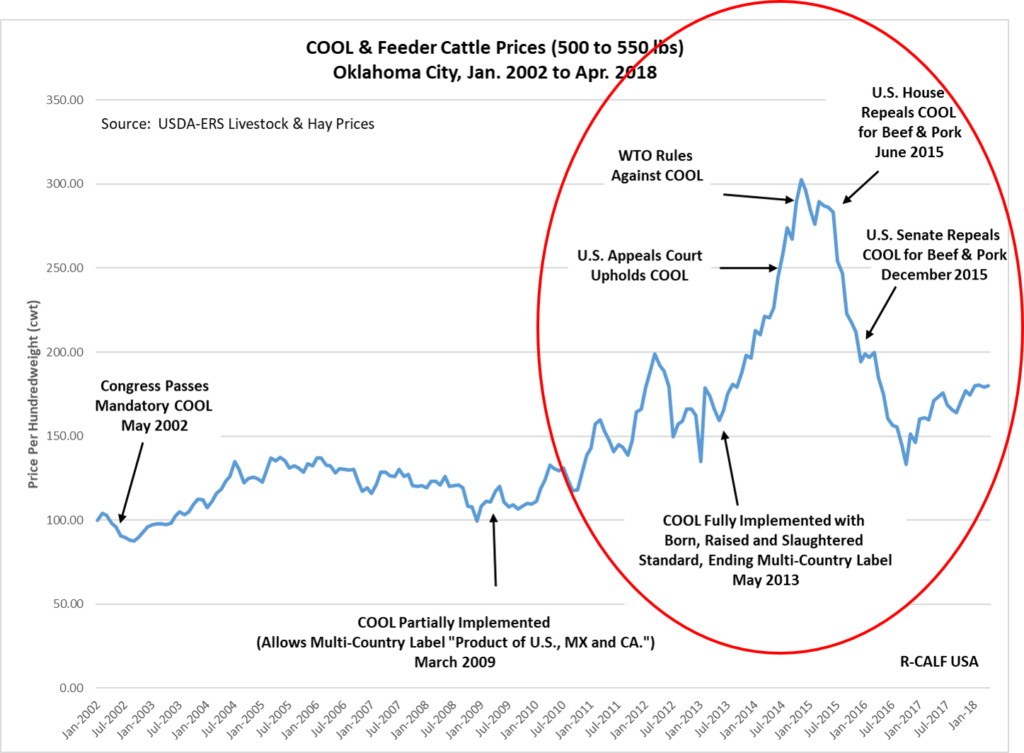

The following slide is from my R-CALF presentation from 2015 as the market was dropping during the effort to repeal Country of Origin Labeling (COOL), putting consumers in the dark about where their beef is from. The eventual repeal of the COOL law and non-enforcement of anti-trust laws gave permission for the big meatpackers and their retailer partners to drastically lower the value of cattle, totally unrelated to supply and demand.

Today, the producer share of the beef dollar is 38.57%, down from 70% in 1970 when there were many meatpackers across the country buying in a competitive market.

The current live market at $1.00/cwt. equals $1,350 live value, divided by the current $3,441.69 retail value, equals a producer share of 38.57%. This low share of the retail dollar has left ranchers and independent cattle feeders bankrupt and meatpackers and retailers swimming in unfair profits.

A finished animal will yield 42% of the live weight into boneless retail cuts. A 1,350 pound live animal will yield 567 pounds of retail beef x $6.07 average retail for a total fresh retail beef value of $3,441.69

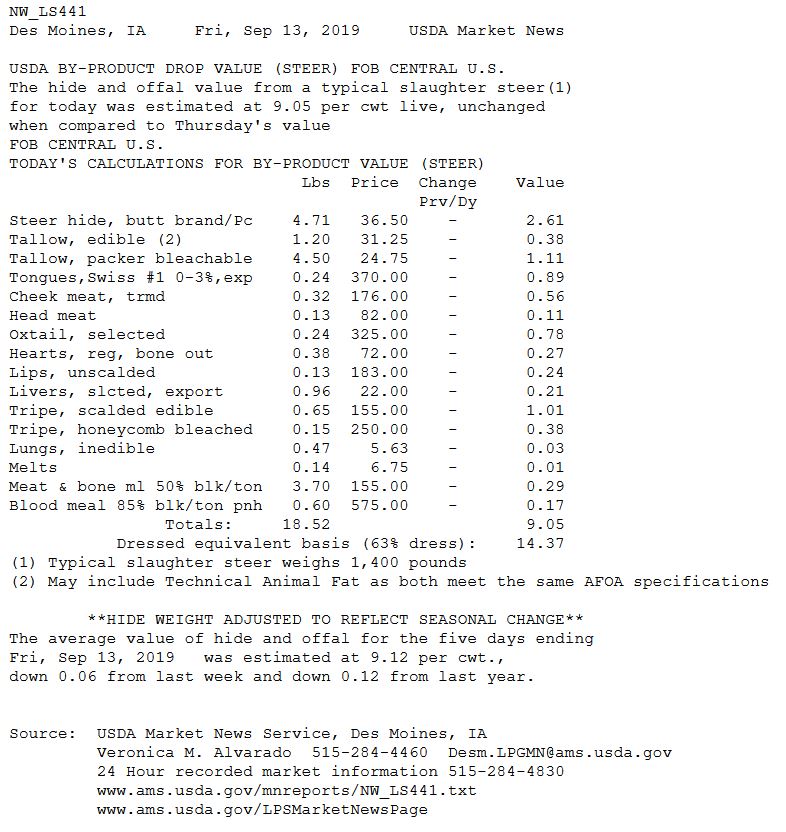

The retail value doesn’t include the packers drop credits (1,350 lb. animal x $9.05/cwt. = $122.17), the retailers 12% added solution, pink slime, value-added, or any of the higher quality hotel, restaurant, institutional (HRI) sales and the cream of the beef supply that is exported at premium prices.

The packer and retailer are sharing $2,272.17 from the sale of a finished animal that cost $1,350. The investment turn is around two weeks.

A competitive market would never allow such outrageous theft.