Meatpacker Concentration – August 8, 1996

“It has been brought to such a high degree of concentration that it is dominated by few men. The big meatpackers, so-called, stand between hundreds of thousands of producers on one hand and millions of consumers on the other. They have their fingers on the pulse of both the producing and consuming markets and are in such a position of strategic advantage they have unrestrained power to manipulate both markets to their own advantage and to the disadvantage of over 99 percent of the people of the country. Such power is too great, Mr. President to repose in the hands of any men.”

Those words were spoken on the floor of the U.S. Senate by Wyoming Senator John B. Kendrick in 1921. Producer complaints and litigation led to congressional hearings in 1918. The five major meatpackers, Armour, Swift, Morris, Wilson, and Cudahy claimed to only controlling 30 percent of the market. It was concluded the five meatpackers slaughtered 70 percent of all livestock and that the vertically integrated monopolistic conditions warranted prosecution under the Sherman Anti-Trust Act. A Consent Decree was struck, forcing meatpackers to divest of all interests other than packing. The Packers and Stockyards Act of 1921 was passed to implement the agreement and to prevent such a monopoly from occurring again.

“Today four meatpackers control 87 percent of beef processing, with one packer, IBP controlling 38%.”

Today four meatpackers control 87 percent of beef processing, with one packer, IBP controlling 38%. In 1979 the producer received 64 percent of the consumer beef dollar. USDA statistics show, by May of 1996, the producer share slipped to 44 percent, representing a 20 percent loss in share. Of the current $1827.00 per head retail beef value, this 20 percent represents $365.00 per head loss to the producer. Put in perspective, from March of 1980 to 1996, the four major meatpackers’ share of the beef, lamb, and pork slaughter increased from 36% to 87%, and the producer share of the consumer meat dollar dropped from 64% to 44%. Consumer prices (retail, hotel, restaurant, and export) for beef have steadily increased. An effort is made to monitor retail prices through a survey. Retail makes up approximately 50% of beef sales and consists of the lowest priced and lesser quality portion of the total wholesale beef supply. The highest quality beef is creamed off at the packing and processing levels and sold at major premiums in the export, restaurant, and hotel trade.

“These corporate giants are well known for their market aggression and have a history of offenses, from price-fixing to manipulating the futures market to short-weighing of livestock.”

In 1921 five meatpackers controlled 70% of the slaughter and owned the related businesses from the stockyards, market newspapers, transportation, public warehouses to retail outlets. Today, the producer is being forced out of business by a meatpacker monopoly far more powerful than the monopoly of 1921. Two of the major meatpackers today, Con-Agra and Cargill are huge multi-national corporations that have totally surrounded the producer from input to output. IBP specializes in packing and processing and has gained 38% of the slaughter market. These corporate giants are well known for their market aggression and have a history of offenses, from price-fixing to manipulating the futures market to short-weighing of livestock.

“In reality, there is only one meatpacker. IBP leads the way and the other packers follow.”

In reality, there is only one meatpacker. IBP leads the way and the other packers follow. As stated in the July issue of CALF News, one Canadian feeder said, “IBP is the price leader here. They always have been and always will be.” In 1992, Wall Street Journal article entitled, “IBP Gobbles Up Weak Rivals in Meatpacking Industry”, a Kansas marketing consulting firm said, “IBP is perhaps the best predatory pricer I’ve seen.” From 1993 to 1995 IBP showed a profit increase of slightly over 350%. The first half of 1996 has surpassed 1995. The cattleman has suffered as much as 40 to 50% drop in prices in the same period. The consumer is paying the same or more for less quality and consistency.

In testimony, before the Concentration in Agriculture Hearing in April of this year, I stated that I had been asked the question; “Do you think there is unfair trade in the marketing of live cattle? My answer is yes. Do you think there is price-fixing and monopolistic activity in meatpacking and processing? My answer is, absolutely, without question and it is also widespread in other areas of agriculture.”

“The meatpacker today has a new powerful weapon developed by IBP that ensures the least cost.”

IBP employee, Curtis Pohl was asked under oath in the IBP Inc. vs Robert Cook trial, “Is it always in IBP’s best interests, as you perceive those interests, Mr. Pohl that IBP buy cattle for slaughter as inexpensively as possible? The answer, YES. The question, Is there an exception that you can think of to that statement, a time when it would not be necessarily in IBP’s interests to buy live cattle as inexpensively as it can? The answer, NO.”

The meatpacker today has a new powerful weapon developed by IBP that ensures the least cost. This weapon has the capabilities of eliminating small meatpacker competition and forcing beef producers’ prices far below their cost of production. Over the last several years IBP has become very skilled in its use. This weapon is called the Formula. The Formula is the equivalent of a nuclear warhead in the arsenal of captive supplies. The Formula has nothing to do with value-based marketing or risk management.

The Formula is an agreement between the feedyard and IBP which effectively commits all the cattle from the feedyard to IBP. The details of the Formula are negotiable and vary depending on the feedyard. IBP takes no risk and invests no money. The feedlot eliminates the worry of selling cattle and frees up considerable management time. The price is determined in most cases by the cash price paid at the IBP Garden City, Kansas and Texas panhandle plants. Determining a fair cash price becomes impossible as the percentage of formula cattle increases.

“The P&S Act prohibits discrimination, preferential treatment, or giving advantage to any particular person or locality.”

Supplied with Formula captive inventory, IBP can stay out of the cash market for extended periods and only buy enough cash cattle so as to determine the Formula price. Formula feedyards are able to move cattle on time, with lower feeding costs, and depending on the agreement; at higher prices, compared to non-Formula feedyards. The P&S Act prohibits discrimination, preferential treatment, or giving advantage to any particular person or locality. During March and April of 1994, IBP stepped out of the cash market and drew from Formula cattle supplies. Live cattle prices dropped from $77.00 to $62.00. Thursday, May 2, 1996, the market jumped from $54.00 to $60.00 in two hours. It is understood that two of the largest Formula suppliers were unable to supply cattle for two weeks, forcing IBP to compete for cash cattle. There is potentially no limit to the downside effects this can have on a cash market, given sufficient numbers of formula cattle. Any number of Formula cattle is bad, and a large number completely destroys equitable price discovery.

As feedyards tire of being denied market access and are forced to trade cash cattle in a narrowing marketing window at declining prices, interest in the formula increases. In many cases, especially outlying feedyards, there is no choice but the formula.

“IBP leads the way in setting the market every week, and armed with Formula cattle, they are very effective in improving the margins for all the packers.”

It is understood in the industry, that recently, IBP and Cargill have reached an agreement to work together, with Cargill providing a very large number of cattle to IBP on a Formula basis. Some people ask why the two largest meatpackers would work together when they should be competing and why Cargill doesn’t kill their own cattle? Cargill and ConAgra both benefit when IBP forces the market lower with formula cattle. IBP leads the way in setting the market every week, and armed with Formula cattle, they are very effective in improving the margins for all the packers. Realizing the Formula’s negative impact, some feedyards are pulling out of Formula arrangements. Cargill is simply replacing and adding to the number of IBP Formula cattle, thereby improving both meatpacker’s total profit picture. This arrangement is in clear violation of the P&S Act of 1921.

“If the rancher and feeder are receiving less and consumers are paying more for lower quality, someone is making a lot of money in the middle.”

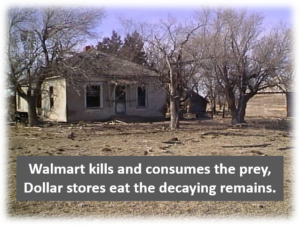

Many ask, how can this be happening in a free market, democratic society? Why aren’t the anti-trust laws being enforced? People outside the industry understand the problem within minutes when told of the low cattle prices. They say, our price of beef at the consumer level has continued to increase and the quality has declined to the point that much of the beef is unfit to eat. If the rancher and feeder are receiving less and consumers are paying more for lower quality, someone is making a lot of money in the middle. Where does the good beef go?

Todays, low cattle prices have nothing to do with cattle cycles or oversupply. The problem is a lack of competition and price discovery and the existence of a powerful, politically strong meatpacker monopoly. With captive supplies, it is easier for the meatpacker to buy cattle cheaper than to sell meat higher. Captive supplies have allowed the meatpacker and retailer their widest margins in history, at the direct expense of the producer. An economist and ex-employee of one of the major meatpackers who cleared over $3.5 billion dollars worth of cattle and hog payments across his desk, has said, “They always beat up on the feeder to increases their margins.“ The feeder is the course of least resistance. Given captive supplies, how much are cattle worth if they don’t need them? Especially if the cash cattle they don’t need, set the price on the captive cattle. A Scott County, Kansas feedyard operator, when asked about low cattle prices, stated, “This is price-fixing, it’s meatpacker concentration.”

“NCBA has a responsibility to lead, drag, force – kicking and screaming – beef producers into coordinated production systems just as the National Pork Producers Council (NPPC) has led pork producers.”

One Ag-industry writer states, “NCBA has a responsibility to lead, drag, force – kicking and screaming – beef producers into coordinated production systems just as the National Pork Producers Council (NPPC) has led pork producers.” According to USDA, pork has lost more market share than beef. One leading South Carolina pork producer said, “At the current rate, within five years there will not be an independent pork producer left, the lowest-cost producer is the family operation, but they give up the cost advantage when they are denied equal market access.” Top-down vertical integration enslaves the producer, threatens the family, the food supply, and rural America.

“We are constantly reminded of the importance of open trade as the equivalent of 4 billion pounds of beef is imported across our borders.”

While domestic beef producers bear the burden of unrestricted beef imports, USDA reports that there are tight import barriers on poultry to protect domestic poultry producers. Combine that with inspection inequities and water addition to poultry products; beef’s competitive challenge increases. We are constantly reminded of the importance of open trade as the equivalent of 4 billion pounds of beef is imported across our borders. Poultry’s one-way border policy doesn’t appear to be causing much pain, with 4 billion pounds of poultry exported last year, compared to beef exports at 1.8 billion pounds.

The cattlemen’s own representatives, the NCBA, the Kansas Livestock Association (KLA), and the Texas Cattle Feeders Association have all either actively promoted the meatpackers position or at best stayed on the fence on the captive supply issue. To this day, NCBA and KLA blame low cattle prices on oversupply. 100-year-old family-owned, Standard Meat Co., Lincoln, NE says there is a critical shortage of high-quality meat, and meat prices have no correlation with live cattle prices. Twenty-five years ago, Standard Meat Co. pioneered some of the first export business to Japan, only to be priced out, by the big packers. Standard does no business there now, and recent reports show a high level of foreign importer dissatisfaction with the arrogance, poor service, and products of the big packers. As one researcher stated, “One could assume in a more competitive market, these buyer’s issues would have been addressed.”

NCBA and KLA are unphased by the drop in the producer’s share of the consumer’s beef dollar. They totally ignore the comparison of live cattle prices to consumer prices. They ignore the Formula’s devastation of price discovery. NCBA economist, Chuck Lambert, distorts, twists, and misstates the facts. One leading industry spokesman in reference to the NCBA said, “Let me know if you have any ideas for an attack plan including getting a job for Lambert at IBP where he belongs.” Their policy opposes government regulation of private business transactions. Do they believe the P&S Act and the Anti-Trust laws that protect free enterprise and open competition should not be enforced? Speaking of regulating private business transactions, I wonder how they feel about other forms of price-fixing and market manipulation. These are top-down-run organizations, not grassroots.

The latest NCBA and KLA promotion is the elimination of the grading system and the brand naming of beef by the meatpackers. Brand naming of beef by the meatpackers is the reason we have a grading system. Swift, Wilson, Cudahy, and Armour bought commodity beef and brand named it. There was no basis for determining value, so the grading system was developed to establish a measurement of value. It is not necessarily a good measure today, but it is all we have.

“The meatpacker and retailer capture the entire premium after buying the cattle at commodity prices.”

The Certified Angus Beef program and Excel’s Sterling Silver are good examples of high-priced branded beef products that the producer receives no premium for. The meatpacker and retailer capture the entire premium after buying the cattle at commodity prices. If competition is restored to the beef business, and the avenues opened for new entries to the market, you will see many new branded beef products, with a guarantee of quality and consistency to the consumer. These new companies will be producer-owned and driven with their good name as the grade. Consumers worldwide will demand this high-quality U.S. produced beef. The producer who invests the capital, takes the risk, and is passionate about the business will listen intently to the consumer and provide the service and products that will build demand. Producer enslavement of the pork and poultry segments is not the blueprints to follow. With equal capital investment from grower-producer and processor in production and processing facilities, the poultry grower-producer receives a 2% to 3% return for labor and investment, while the processor receives over 30%. Poultry and pork producers have had enough and are looking for answers to their dilemma.

The government stands quietly by and continues to waste producer’s money on Concentration studies. One, highly respected Ph.D. of Econometrics called the conclusions of the studies extremely biased, inconsistent, and seriously flawed. He states, “In conclusion, it is extremely unfortunate that even though every fed cattle producer with a Monday morning show list feels the pressure from captive supply, university professors and government agents did not insist on the utmost rigor in providing credible research in quantifying the severity of this pressure.”

“If the researchers would have been my students, they would have failed the course. If they had been employees, I would have fired them.”

The Center for Rural Affairs, who was represented on the USDA Concentration Panel states, “Academic economists should be required to publicly disclose the source and amount of compensation they receive from consulting in the private sector.” Another, well-known University Professor and Researcher stated, in reference to the USDA studies on concentration, “If the researchers would have been my students, they would have failed the course. If they had been employees, I would have fired them.” Another University that was denied any involvement in the studies stated, “The researcher selection process guaranteed the outcome.”

Kathleen Sullivan Kelley, Vice President of the Rocky Mountain Farmers Union, Board member at the University of Colorado, and past professor at the Kennedy School of Govt. states,

“The USDA concentration advisory committee is ethically and substantively flawed and never should have been created in its final form. A policy maker, whose constituency shows a great deal of distrust does not neutralize the distrust by appointing a policy committee consisting of individuals who are the target of the distrust. The problem is only exacerbated.

Every agricultural organization, every university, and every person who cares passionately for our democracy should be calling for a retraction of the Concentration in the Red Meat Packing Industry study. It’s imperative that a General Accounting Office and Justice Department investigation be launched into the conduct of this study. There is no question more critical to cattle producers today than whether of not their price is affected by packer concentration. In the studies failure to use sound research methods, USDA may have very well cost the livelihoods of thousands of American Cattle Producers. Perhaps they can live with the results, but cattlemen can’t.

A new study must be commissioned. The researchers must be free of bias that corporate research grants most certainly create. The study must be comprehensive, examining, comparing and contrasting data from several different time frames until final, definite answers to the most critical questions concerning market concentration are provided.

USDA must be held accountable for the lack of appropriate response to this issue. The fact that Secretary Glickman attempted to pass off this study as a conclusive document without demanding more definitive results is a profound example of the lack of leadership producers sense from USDA. The fact that USDA developed a committee process with very few producers appointed, held sessions in the middle of calving season when few producers could attend, never held a meeting in the heart of cattle country and cut off public testimony after only two days of hearings shows a deliberate, hostile bias against producers.

While this may be the politics of this modern age, it is not the politics of integrity, nor is it the kind of politics which will ensure the survival of this democracy.”

“The meatpacker’s representative, Mr. Patrick Boyles, with the American Meat Institute was on the panel and did an excellent job of confusing the issue and sowing seeds of doubt about the effects of concentration.”

Producers are being forced to subsidize Ag production with long hours at part and full-time jobs and spending too little time raising their children. Some go so far as to open their private homes to paying guests, to generate additional income. Corporate giants keep their hand out, well aware of the resourcefulness of the wealth-creating Ag producer. The Corporations own politicians with their contributions. The meatpackers were invited to Governor Nelson’s, Beef States Summit. They declined, but according to the Federal Election Commission, the three major meatpackers were kind enough to send a hefty campaign contribution to Governor Nelson. The meeting was well planned, with the help of the Nebraska Cattlemen’s Assn. Important issues were discussed, however, at the end of the day, many attendees felt, the issue of packer concentration and price discovery received too little attention. The meatpacker’s representative, Mr. Patrick Boyles, with the American Meat Institute was on the panel and did an excellent job of confusing the issue and sowing seeds of doubt about the effects of concentration. Media reporting also lacked coverage of this most important issue. House Ag Committee Chairman, Mr. Pat Roberts, from the big packer state of Kansas, in a televised interview on August 5, 1996, was asked what he thought about the low cattle prices. He said, “There are just too many cows.” The politicians listen to the cattleman’s representative in Washington, the NCBA.

The NCBA talks about a dynamic new beef industry and the importance of all industry segments working together. This sounds good and could work, as long as one segment is not a predator, and the structure is from the bottom up, with the capital investing and risk-taking producers receiving their just rewards.

Mike Callicrate

Callicrate Feedyard, St. Francis, Kansas

913-332-3344

Pingback: Important anniversary coincides with compelling new book | Organization for Competitive Markets

Pingback: OCM – 30% of Nothing is Still Nothing – Level of captive supply cattle should be zero! – News.MikeCallicrate.com | A NoBull News Service