by Gilles Stockton

Grass Range, Montana January, 2017

By now, the disaster that is the cattle market has been factored into the coming year’s budget. For some it means the end of a dream to own a ranch, for the remaining it means a hard assessment about what will be affordable. The disaster is trickling down through the economy, to the businesses that supply goods and services to agriculture, and to the legislators and county commissioners, who are scrambling to fund schools, maintain roads, pay for social services, and law enforcement with less tax revenues. It is a depressing situation but there is a solution.

The solution, however, is only available if we focus clearly on what is wrong in the cattle market. First we must understand that a collapse of 45% to 50% in feeder calf prices cannot be justified by citing supply and demand. Healthy markets do not have these kinds of swings.

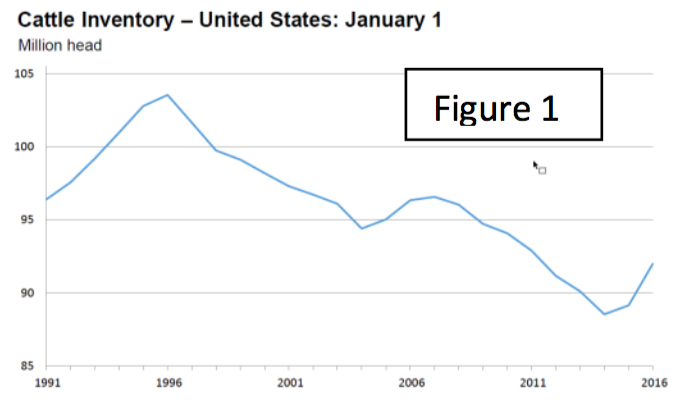

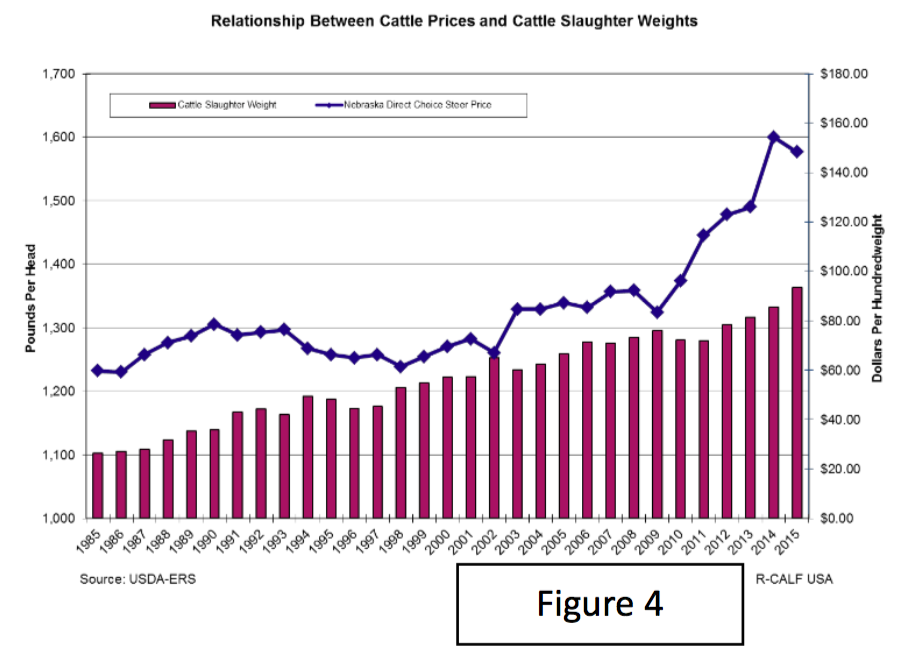

After years of decline to the lowest inventory ever, US cattle numbers were up by a modest 3% in 2016. In addition, the cattle in the feed yards may have been kept a little longer, increasing carcass weights by about 2%. Although these percentages were calculated from USDA sources, it should be understood that 2016 numbers are projections, and we will not know actual statistics for a year or so. (see Figures 1 & 4)

We should also not forget that in 2015 Congress rescinded Country of Origin Labeling (COOL), an action which put negative pressure on the cattle market. There is every indication that COOL was working to promote USA produced beef, which explains the insistence by packers to have it overturned.

On the positive side, however, beef and cattle imports decreased by about 12 percent, and exports increased by 9 percent. This does not mean that the trend is permeant. 2015 had the highest level of imports and lowest level of exports in recent years. The 2016 projections could be just a readjustment to a more normal level of imports and exports, with the long-term trend going for more imports and lower exports. (see Figures 2 & 3)

Also on the positive side we saw lower corn and soybean prices in 2016. With the cost of gain for cattle on feed decreasing, this should have resulted in upward pressure on the feeder calf market.

Yet instead of a modest re-adjustment of cattle prices, the market for cattle nosedived while at the retail level, consumers got only a minimum decrease in beef prices. ![]()

![]()

An additional indicator that something is not as it should be is the Chicago Mercantile, which suspended trade in cattle futures because the spot market for fat cattle, a necessity to settle contracts, went up in smoke. When the professional gamblers push away from the table, the cowboys should take notice that something is fundamentally wrong.

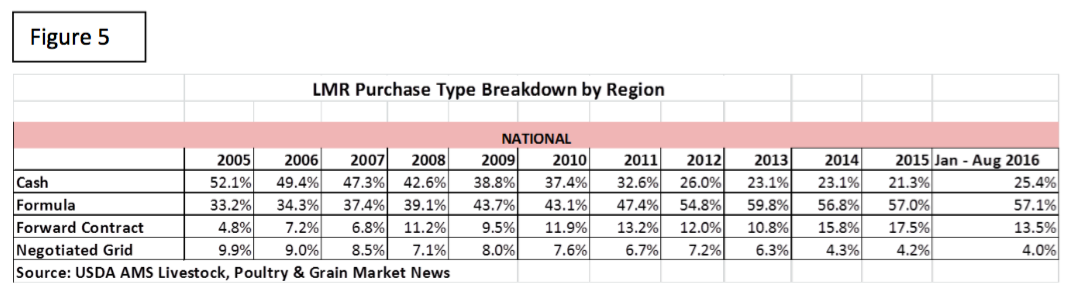

The disappearance of the spot market for fat cattle is the crux of the dysfunction in the cattle market. Unpriced captive supply contracts and arrangements now dominates the relationship between cattle feeders and packers.

The solution is simple. Competition must be restored in the cattle markets by requiring that packers price their supply in a publicly traded market.

The solution is simple. Competition must be restored in the cattle markets by requiring that packers price their supply in a publicly traded market.

This was first proposed in 1997 by the Western Organization of Resource Councils (WORC) in a petition for rulemaking to the Secretary of Agriculture. The entire legal and economical rational can be found in the Federal Record (Vol. 62, No. 9 Tuesday, Jan. 14, 1997, page 1845). USDA held a hearing on the concept, but administrations changed and the Bush Administration was not interested in pursuing the matter. The concepts first proposed by WORC, were picked up in 2007 by a handful of western Senators (both Republican and Democrat) and proposed as the Captive Supply Reform Act (110th Congress, 1st Session S. 1017). But because livestock producers did not demand passage of this act, it languished.

The arguments for restoring integrity and competition to the cattle markets by actually enforcing the Packers and Stockyards Act (P&S Act) are legally sound, economically elegant, and morally correct. The rule proposed by WORC in 1997 has two parts. The first is:

No packer shall procure cattle for slaughter through the use of formula or basis price forward contracts. All forward contracts used by packers for purchase of cattle slaughter supplies shall contain a firm base price that can be equated to a specific dollar amount at the time the contract is entered into and be offered or bid in an open public manner.

The second part:

No packer shall own and feed cattle unless those cattle are sold for slaughter in an open public market.

The rule is premised on requiring packers and feeders to switch from a secret negotiated price system, to a public bid market, presumably in an electronic format. Such an electronic market would function for both immediate delivery (spot market) and for delayed delivery (forward contracts). Electronic market auctions, such as commonly used for feeder calves, have proven to be highly efficient and a very cost effective method to clear a market. By using an electronic auction for fat cattle, everything would be above board, publicly open, and completely neutral as to the size of the sellers and buyers.

The second part of the rule proposed by WORC presumes that beef packers may, as they do in their hog and poultry subsidiaries, prefer to be in the cattle feeding business as well as slaughter. If that is the simple case, and in order to not be in violation of the Packer’s and Stockyards Act, packers should be required to make the finished cattle available for purchase to all potential bidders through the same electronic market system. If it is a blind bid auction, they can buy their own livestock back without violating the Act.

Inexplicably the criticism of Captive Supply Reform was that this would be an interference in the “marketing preference” of livestock feeders. This is puzzling argument. A livestock feeder should either want to sell for immediate delivery or know in advance the terms, the price, and the date of delivery. What other kind of “marketing preference” is there unless a livestock feeder actually prefers to not have any say, what so ever, in determining delivery and price. Which is incidentally, the situation faced by contract poultry and hog growers.

An electronic market for forward contracts could accommodate all manner of flexible terms and incentives. If for instance feeders and packers would like to base the final price with a premium calculated from the market at the date of delivery, there is no reason that the forward contract could not accommodate that desire on the condition that a competitive spot market actually exists. The only requirement imposed by Captive Supply Reform is that a base price be set at the time the forward contract is entered into. Premiums for meeting certain goals could also be included in the contract. In addition, if the feeder’s cattle were of a quality that fit a special market brand, but the packer managing that branded beef program did not offer the highest bid, there is no reason that the feeder could not choose the lower bid. It is unclear why they would do so, but they could. The only “market preference”

that this rule does not accommodate is that of contract servitude.

History of attempts to reform the cattle market.

Winston Churchill is supposed to have said, except that it is apparently not true that he actually did: “Americans will always do the right thing, only after they have tried everything else.” The same can be said about the livestock industry which has tried every possible solution to fix the dysfunction in the market system accept the one that will actually do the job.

The first attempt came from the National Cattlemen’s Beef Association (NCBA) when they backed mandatory price reporting of cattle sales. The NCBA’s probable motive was to prevent a more effective measure to enhance competition from being considered. Mandatory Reporting came to nothing since the four beef packers insisted that what they pay for cattle is proprietary information and that because there are only four packers controlling the market, their competitors could infer what each individual packer was paying and how many cattle they had committed. USDA immediately backed down and keeps the reported information confidential. Mandatory Reporting is a good idea that came to nothing because the cattle market is controlled by a cartel. It would not have, in any event, solved the dysfunction in the market because the problem with the market is that in fact, it is controlled by a cartel.

Next tried was Country of Origin Labeling (COOL) which was made law in 2002. The idea, from the respect of livestock producers is that consumers at retail would be able to distinguish between foreign and domestic product. The hope was that consumers would prefer to buy domestic beef which would give producers an opportunity to build a “Born, Raised, and Slaughtered in the USA” brand which in turn would support better prices. Consumers are more than ninety percent in favor of a country of origin label.

The packers went berserk. Every possible objection and delaying tactic was employed to prevent COOLs implementation. Following a World Trade Organization (WTO) objection filed by Canada and Mexico on behalf of the packers, COOL was not fully applied until 2013 when USDA published the final label requirements. This, however, was not the end because the governments of Canada and Mexico objected to the revised label requirements as well. Eventually a WTO tribunal ruled that COOL somehow violates our trade agreement with Canada and Mexico. The packers could not even wait for the WTO process to come to a final conclusion and in 2015 directed their captive supply Congresspersons to rescind COOL. COOL is a good and useful idea which helps to brand and market US produced beef. The indications are, that COOL was actually performing as cattlemen hoped, which is why the packers were so insistent on killing COOL. However, as good as COOL was, it did not get to the heart of the reason for the dysfunction of the livestock market.

In 2008, USDA, responding to a directive from Congress to address the problems faced by poultry growers in their business relationship with the poultry integrators, proposed the GIPSA Rule (Grain Inspection, Packers and Stockyards Administration). This rule, “…would clarify when certain conduct in the livestock and poultry industries represents the making or giving of an undue or unreasonable preference or advantage or subjects a person or locality to an undue or unreasonable prejudice or disadvantage.”

Section 202 of the Packers and Stockyards Act, states clearly that packers cannot give undue preference or prejudice in any transactions with buyers or sellers. The problem comes from Federal Judges who seemingly have trouble understanding what might be “undue” or “unreasonable” in a livestock market context. The GIPSA Rule supplied a “laundry list” of actions that constitute “undue or unreasonable preference or prejudice.” These definitions addressed actual complaints made by contract poultry growers and pork producers. However, the beef industry is not structured the same as the poultry and hog industries and has not experienced the same level of vertical integration. For cattle producers, the GIPSA rules would not have been that useful in solving the market problems.

There was, however, one clause in the GIPSA Rule that was applicable to the cattle industry. The Federal Courts, in previous cases had come to the conclusion that a producer claiming discrimination by a packer had to show that this discriminatory action harmed the entire industry and not just that single producer. This is a ridiculously impossible standard and rendered the P&S Act essentially useless in protecting producers from harm in marketing and contracting. The GIPSA Rule stated that producers did not have to prove “harm to overall competition” when arguing that they had been subject to acts that were “deceptive,” “unfair,” “unjust,” “undue” or “unreasonable.”

The Republican dominated House of Representatives immediately declared that USDA had overstepped the Congressional directive and forbad the Secretary to use any authorized funds to implement the GIPSA Rule. Reform of the livestock market was essentially dead for the next six years, until the fall of 2016 when Secretary of Agriculture Vilsack proposed a new revised and pared down version of the GIPSA Rule. It did not take long for organizations such as the National Pork Producers Council (NPPC), The National Chicken Council (NCC), and National Cattlemen’s Beef Association (NCBA) to attack the abridged version of the GIPSA Rule on the principal that it should continue to be legal for Packers to engage in deceptive, unfair, unjust, undue, and unreasonable practices. How the Trump Administration will deal with the abridged version of the GIPSA Rule is still an open question.

There was one additional effort to reform the dysfunctional livestock market, that was floated by hog producers who were facing the disintegration of the competitive hog market. They asked for a ban on the ownership of livestock by packers. This initiative did not consider that if packers could not own livestock during the fattening phase, they could still enter into unpriced captive supply contracts and arrangements with cattle and hog feeders. In any event this attempt did not reach the level of real consideration. Also, like Mandatory Reporting, COOL, and the GIPSA Rule, the ban on packer ownership did not get to the heart of vertical integration and market concentration.

Vertical Integration in the beef industry

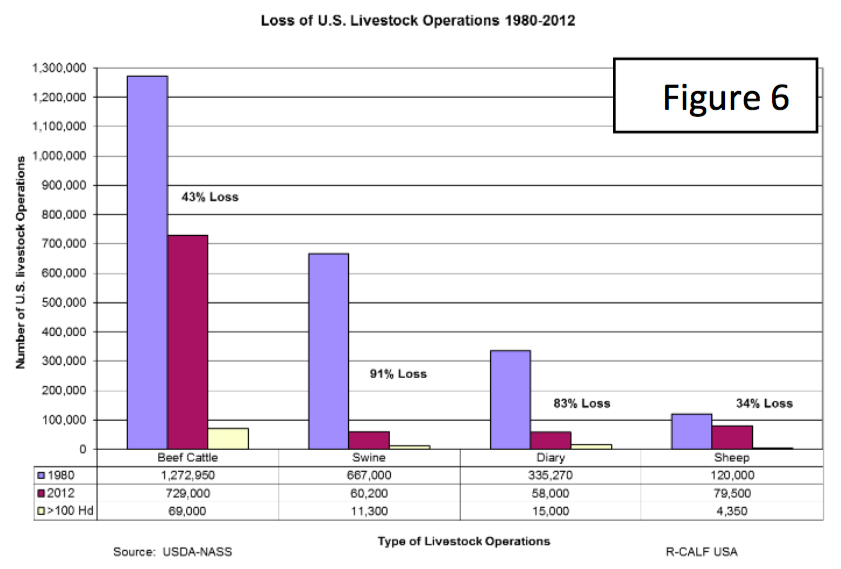

Because beef cattle are raised in two stages – cow/calf and then feeding – many cow/calf producers assume that they are immune to the kind of vertical integration experienced by poultry and hog producers. Hog producers probably felt that they too were safe from vertical integration, but when the decision to integrat the hog industry was made in the mid- 1990s, it did not take long to eliminate the independent hog producer. Today only 2.6% of hogs are sold in a public spot market. An independent pork producer can raise all of the pigs he wants to, it is selling them that is the problem. (See Figure 6)

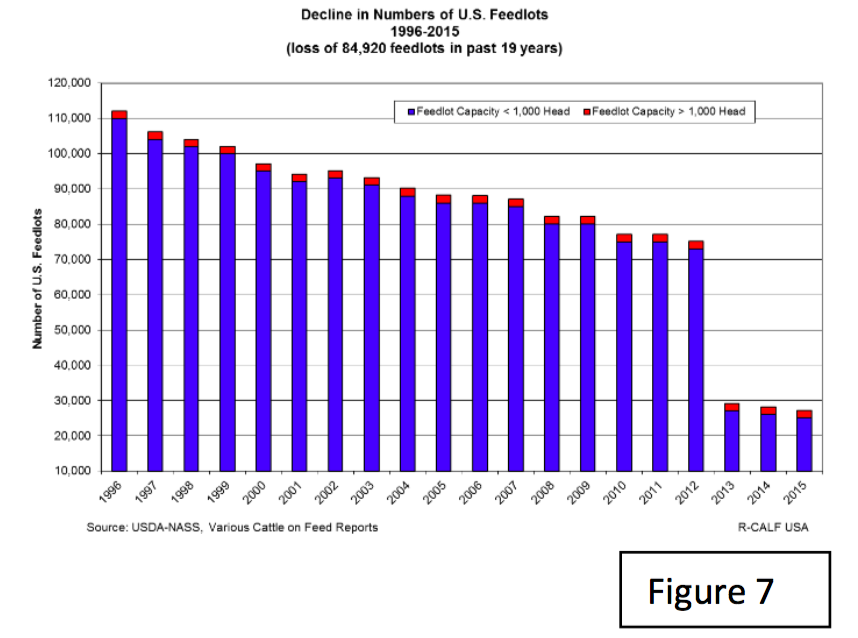

Cattlemen have been concerned about concentration in beef packing since the mid-1980’s when it became apparent that a monopoly was forming. Although the numbers of cattle producers have steadily fallen over that thirty year period, cow/calf producers are still essentially independent and market many of their calves through auction yards or video/electronic market systems (See Figure 6). Cattle feeders, however, were systematically vertically integrated into a captive supply procurement chain allied to one of the major packing firms. Independent feedlots have been eliminated, the spot market disappeared, and now a small number of large feeding firms control most of the fat cattle. The 2016 market season was pretty much the end for independent feeders. (See Figure 7)

![]()

Cow/calf producers clearly receive the residual prices after everyone else’s margins and profits have been subtracted. Over the last 25 years the producers share of the retail beef dollar has fallen from more than 60% in 1990 to 45% in 2015 ( See Figure 8).

We don’t yet know the statistics for 2016, but the cow/calf operators share has most certainly plummeted over the past year. The packers over that same 25-year period have been able to hold on to their share of the consumer dollar but it is at the retail level where that 15% of the consumer dollar lost to the primary producer has been gathered. Retail chains are clearly the dominate price setters. In order to maintain their profit margins, packers look down stream and pay less for fat cattle. Feeders in turn squeeze the cow/calf sector.

Chances are the packers do not want to own the land and the mother cow herd. It is more convenient and less risky for them, to leave the cow/calf sector independent as land owners but not necessarily independent as feeder calf suppliers. Control is exerted through low prices, fewer buyers, and imposed requirements such as source verification and pre-conditioning of calves.

We see the pattern. At first, pre-conditioning and source verification by placing RFID tags were options for which premiums were paid. Now both are required and there is no longer a premium. Although from a veterinary perspective, pre-conditioning, is a good idea, it can be a very expensive practice for ranches with remote pastures in mountainous or rough country. The source verification information now provided for free most certainly goes into a data base where producers are ranked and compared.

The imposed requirements can only increase. In the future, will pre-conditioning be sufficient, or will cow/calf producers be required to wean and hold the calves for a number of weeks before they can be shipped. Pre- approved genetics, and other types of required management practices, such as the use or non-use of growth promotors, are most certainly coming as cow/calf producers are herded into market chains. What is left of a competitive market for feeder calves will wither away and the cow/calf sector will be vertically integrated in practice if not in name. Unlike contract poultry and hog producers, they will not even have a contract. Cow/calf producers will just be captive suppliers.

Why regulate packers but not the retail cartel.

Some may question why focus this argument on reform at the packer level when it is retail that is controlling cattle prices. The reason is that the P&S Act only regulates packers. The growing, hegemony, of a small number of very large retail grocery chains (Walmart, Kroger, Safeway, and Publix) are regulated by other antitrust laws that do not have the same nondiscriminatory language. The retail grocery cartel deserves scrutiny by anti-trust officials, but that is an even more complex issue. The P&S Act is the legal tool available to cow/calf producers and the P&S Act clearly requires that packers not discriminate in buying cattle and in selling meat.

When packers negotiate exclusive supply contracts with a retail chain, this is just as much a violation of the P&S Act as when they have exclusive agreements with certain feedlots. The way for packers to avoid being in violation of the P&S Act is to sell meat through an electronic blind bid auction system.

Would eliminating captive supply actually result in market relief.

Breaking up the packers would, of course, be the most direct method to restore competition. Economic research has suggested that all economies of scale in meat packing are met in one of the large modern packing plants capable of slaughtering 2% to 3% of the national daily kill. This means that there could be 25 to 30 packing companies, all competing against each other without a diminution of production efficiency.

However, politically and legally, breaking up the packers would be a difficult and lengthy process tied up in years of litigation. It is not at all certain that breaking up the packer cartel would be successful. Going the route suggested by WORC and the Captive Supply Reform Act would not provide immediate relief from low cattle prices and in a sense, this is the strength of this approach. What Captive Supply Reform does is set up the conditions for the industry to change. It would be an evolutionary rather than revolutionary process.

Evolution was the approach taken in 1921 when the P&S Act was passed and a consent decree was entered into with the dominate packers of that era. In those days, producers sent their livestock by train to central packer owned stockyards in places like Chicago and Kansas City. The livestock were priced only after they arrived. The packers owned the boxcars in which the animals were shipped, they owned the yards, and they owned the buyers. The consent decree required the packers to divest of the stockyards and the railway cars.

This allowed for a competitive market to develop when new packers entered into the business and the industry evolved to one that was much less concentrated. After the passage of the P&S Act, public auction yards became the main system for pricing livestock. By 1975 the packing industry was at its least level of concentration.

Starting in 1980 USDA and the Justice Department essentially stopped anti-trust enforcement. As a result, thirty-five (35) years later, not only meat packing but just about every industry that you can think of is dominated by a handful of firms and many control their industry on a global basis. Ours is an era of extraordinary economic concentration and political power by trans-national corporations.

Opposition to competitive market reform

There are two paths to relief. The rule as proposed by WORC, requires that the Secretary of Agriculture exercise his authority to interpret the Packers and Stockyards. The Captive Supply Reform Act instead, would be Congressional action that would direct the Secretary to restore competition through enforcement of the P&S Act. Both paths are valid and probably should be pursued simultaneously.

The opposition to reform will be intense and not in the least constrained by the truth. The same old tired, condescending, and hysterical arguments be will levelled by the NCC, NPPC and NCBA. For instance, this statement comes from Tracy Brunner of the NCBA opposing the currently considered abridged GIPSA Rule: “…this rulemaking will drastically limit the way our producers can market cattle and open the floodgates to baseless litigation. In a time of down cattle markets, the last thing USDA needs to do is limit opportunity. The fact of the matter is, we don’t trust the government to meddle in the marketplace.”

The NCBA’s condescension towards producers struggling to be treated fairly in the market place is amazing. It is doubly so when one considers that were it not for a government program that showers the NCBA with government collected Beef Checkoff tax money, the NCBA would probably not exist as an organization. NCBA makes four points against the abridged GIPSA Rule, and will make the same four arguments opposing Captive Supply Reform because they have nothing else. We can, therefore, consider the validity of these arguments:

1. Limit the way producers can market cattle: The only limit Captive Supply Reform would make on the market, is on secret under-the-table agreements designed to manipulate prices for all of the rest of the producers. Forward contracting would be available to all of those who wish to market in that manner. There could, also, be a public market for long-term production contracts to accommodate the poultry and hog sectors which are fully transitioned to contract production. Raising livestock, or for that matter all manner of crops under contract is a perfectly legitimate mode for agriculture as long as the terms of the contract are fair. If the contracts are publicly available to all producers who meet the criteria or entered into through a public auction system, then competition is protected.

2. Open the floodgates to baseless litigation: Why would litigation following reform be baseless? Is it just when farmers and ranchers have legal complaints that the litigation is baseless because corporations are always suing each other and everyone else. Poultry contract growers have been subject to all manner of underhanded actions by the poultry integrators, such as not being allowed to witness their birds being weighed. Would it be a baseless lawsuit if a grower suspected that the birds he raised were being systematically under weighed. Ordinary people do not resort to a lawsuit against a gigantic corporate power unless they have a valid complaint. They only do so at a last resort and because they have nothing left to lose. NCBA’s argument is just pure arrogance

3. In a down market, USDA should not limit market opportunity: The exact time to do something to restore competition in cattle markets is when prices are down. Cattle prices are down because the market is non-competitive. If not now, then when should competition be restored?

4. Do not trust the government to meddle in the market: Who does trust the government to meddle in the markets? After all it is the government that did not enforce the anti-trust laws for the past thirty-five (35) years allowing a livestock cattle market to develop that is clearly non- competitive and just as clearly dysfunctional. The government needs to step up and do the job that is required of them by the Constitution and by legally enacted law. Anti-trust laws were not enacted in order to punish corporations for doing well, instead anti-trust laws protect competition, not the individual competitors. It is through market competition that efficacy in production, and innovation are enhanced. An industry dominated by a small number of corporations will cease to be efficient and innovative. Their business model will shift to limiting competition by start-up companies, squeezing suppliers, and shortchanging customers.

The government’s responsibility is to ensure the opportunity for competition because under conditions of actual market competition, an industry will evolve to a structure that is most efficient. Only through market competition can society determine what size and structure is truly most efficient. In cattle packing, it may be that having just four dominate packing companies (JBS, Tyson, Cargill, and National), is in fact the most efficient structure. If after restoring competitive pricing for fat cattle, and the same packers maintain their market dominance, then we will know that this is what the market decrees. If, however, smaller competitive packers come into existence, we will know that the beef cartel was not efficient.

The P&S Act has one last unique provision not included in other anti-trust laws. It requires that packers not: “…engage in any course of business or do any act for the purpose or with the effect of manipulating or controlling prices, or of creating a monopoly in the acquisition of, buying, selling, or dealing in, any article, or of restraining commerce.” The key word here is “effect.” Other antitrust laws require proof that there was the intent to manipulate or control prices in order for the government to correct the market imbalance. The P&S Act, requires redress if the market is in fact being controlled. Economic research has shown conclusively that with increased use of captive supply arrangements, cattle prices on the spot market decreases.

Imports role in lowering cattle prices and reducing competition

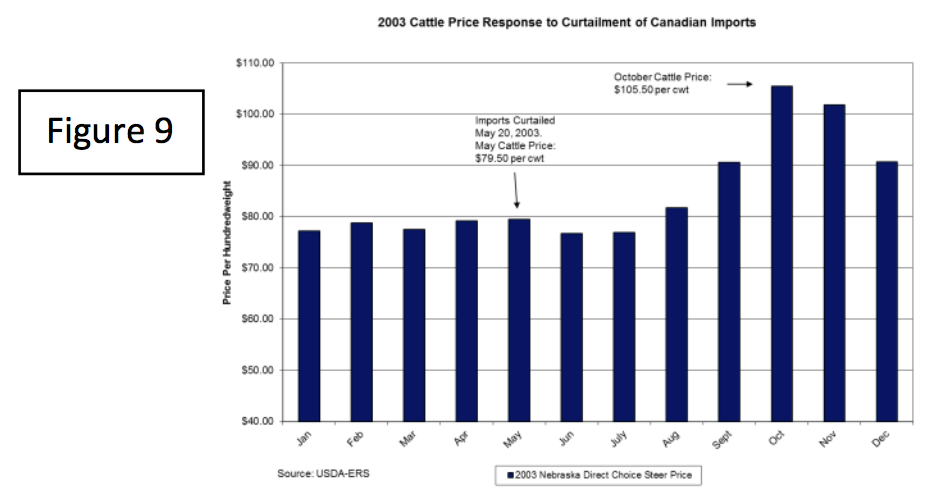

In 2003 we experienced an interesting test of the integrity of the cattle market, when Canadian cattle imports were blocked because of the outbreak of BSE (Mad Cow Disease) in Canada. Feeder calf prices immediately jumped 25%, far more than what one would expect from the removal of that relatively small number of cattle from the US market. What this event revealed is that the Canadian Cattle were being strategically used by the packers as a “foreign based captive supply” for the purpose of controlling the market. (see Figure 8)

The realization that cattle and beef imports are being used to control prices in the US has since made beef imports a major concern for cattle producers. This is why producers are very skeptical of entering into additional trade agreements. The Captive Supply Reform effort would require that cattle and beef imports by a beef packer be publicly priced before being imported. This would prevent an international packer, such as JPS, from importing beef from their slaughter plants in Australia and South America in a manner that manipulates the domestic cattle market.

What is at stake and what it will take to win.

Over the past fifty years, the structure of agriculture in the US has changed dramatically. We were once a nation of independent small farmers, each selling into a competitive regional market system. Many farmers are no longer independent and agricultural markets are no longer regional nor competitive. Cow/calf producers are the only major commodity sector in which producers have maintained a measure of independence.

There are a lot of benefits – on the personal level, for our families, for the communities in which we live, and for our nation – in maintaining a healthy independent farming structure. Our country may very well come to regret the demise of independent farming. It is not too late for the cow/calf sector to stop the slide to vertical integrated serfdom, but it is nearly too late. Captive Supply Reform is possible but will require an intense coordinated effort on the part of the organizations that represent us in Washington.

The concern is that we are divided, not only by organizations who make it their mission to lobby in favor of packer monopolization, but between the different independent organizations as well. Organizations representing independent livestock producers are struggling to maintain their memberships and are jealous of one another. Unless members insist that restoring competitive markets is the priority, these organizations will each go their separate ways pursuing their own priorities of policy reform, and our voices will be diluted. If that is the case, we will lose. There is a solution – but it is in our hands.

(I would like to thank USDA, R-Calf-USA, US Cattlemen’s Association, The Organization for Competitive Markets (OCM), and the law firm of Stewart and Stewart for supplying graphs and statistics for this article)

Gilles Stockton

Grass Range, Montana January, 2017