2001

– Producers 40% —–Packers and retailers 60%

Four firm beef packer concentration increased from 36% in 1975 to over 80% in 2001.

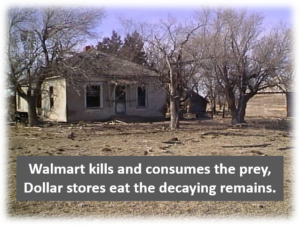

Price leader, Tyson/IBP along with their new partner Wal-Mart, can now manage both supply and demand of beef, poultry, and pork.

Economists Russell Parker and John Connor in their study, “Monopoly Effects on Producers and Consumers,” related the following:

“In about 1950, economists and econometricians started doing statistical studies relating the level of concentration to the level of profits. Some of the studies related concentration to the level of prices, and others to price-cost margins computed by the Bureau of the Census. All of these variables roughly measure the same thing: the costs of high concentration. Nearly all of the studies showed a positive relationship: as concentration increases, profits, consumer prices, and price-cost margins increased.

“The studies were also interested in looking for critical levels of concentration. If they could be identified they would be very useful to public policy considerations. Is there some range of concentration where industries are workably competitive? Is there a concentration value below which antitrust authorities and other public policy organizations shouldn’t be concerned? Beyond this critical point does concentration rapidly become a problem?

“Models which were specified to determine if there was a critical level have shown that up to about the 40-percent level of four-firm concentration, there is no evidence that concentration is related to the levels of prices, profits or price-cost margins. In other words, industries with that level of concentration or lower are effectively competitive.

“Starting at about the 40-percent level of concentration, prices and profits start increasing and go up rapidly to about the 60-percent level of concentration where they level off. There is no significant further increase in prices or profits beyond about the 60-percent level of four-firm concentration. The conclusion is (pointing at the figure) that the effect of monopoly starts appearing when concentration goes above 40 percent and by the time concentration reaches 60 percent an industry is quite monopolistic.”

This information backs up my contention that the market is simply an illusion. The market is totally disconnected from supply and demand and is simply what the packer wants it to be.

I believe price is maintained at the level at which the producer can be mentally conditioned to accept the price. Major beef publications, so-called producer associations, universities and market analysts constantly tell the producer that low prices are their fault despite the fact that consumers are buying record volumes of beef at record high prices. The big retailer is profiting also. It is easier for the packer to buy cattle cheaper than to sell meat higher to the also highly concentrated retailers with the leverage of anti-competitive captive supplies.