Twenty-one years ago this week, the National Cattlemen’s Beef Association advised cattlemen all was well.

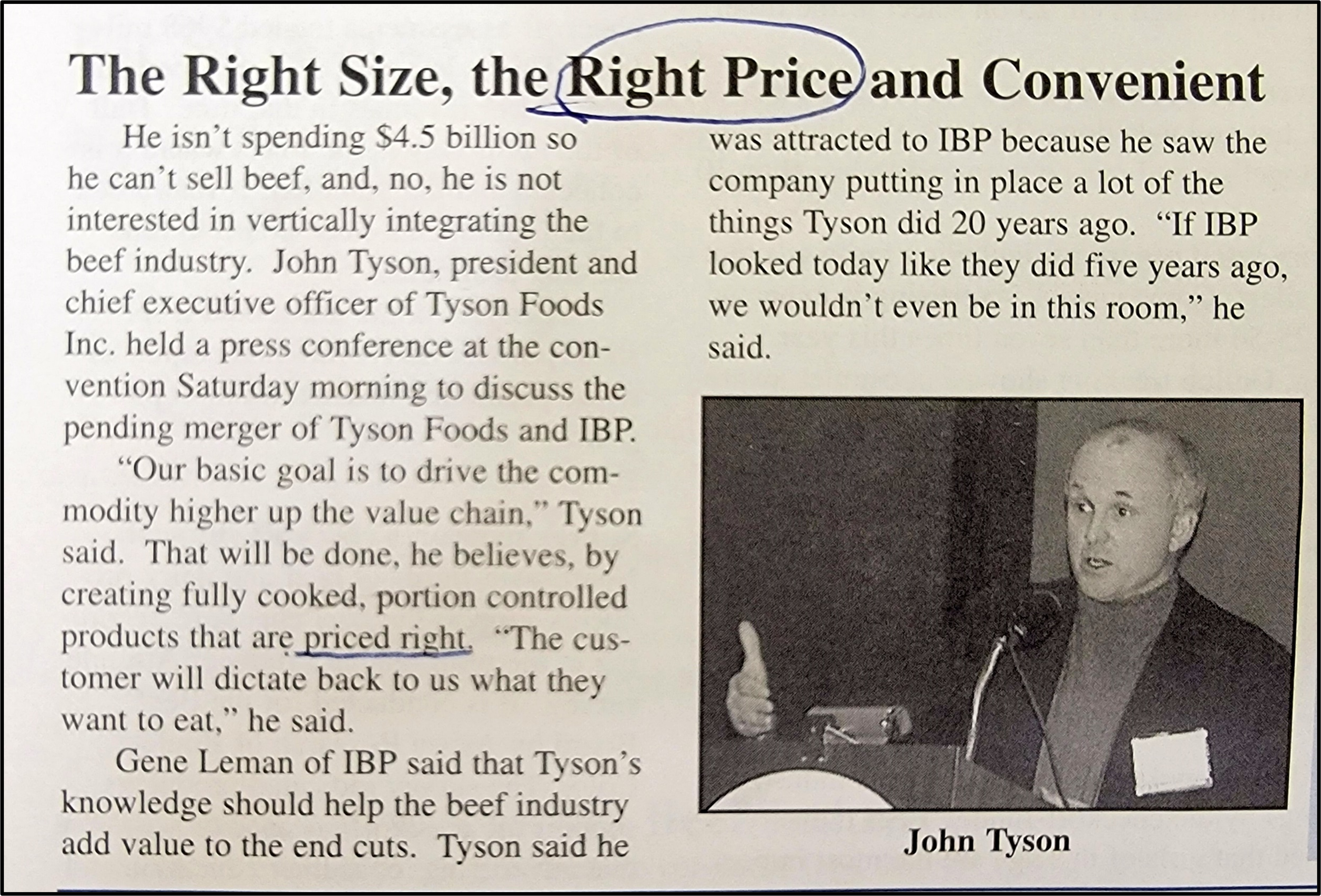

What was the real reason Tyson bought Iowa Beef Processors (IBP), the biggest beef packer in the world,?

“Tyson said he was attracted to IBP because he saw the company putting in place a lot of the things Tyson did 20 years ago.”

John Tyson claimed he liked IBP because it was becoming more like the chicken industry.

Did Tyson, having profitably captured the poultry supply chain, see the use of the IBP Formula as a better way to control livestock supplies without the expense and risk of owning the animals? Eliminating the capital intensive ownership of livestock, especially cattle, would show a big return on investment for Tyson shareholders. Owning the chickens and the feed, while indentured growers owned the growing facilities, the dead birds and the manure, wasn’t nearly as good a deal as what IBP had innovated with the Formula. The Formula pushed the huge investment in livestock, and the work and risk, onto ranchers and independent cattle feeders, and control of the inventory and priceless ability to manage and manipulate market prices to IBP, soon to be Tyson.

“The Formula is the equivalent of a nuclear warhead in the arsenal of captive supplies.”

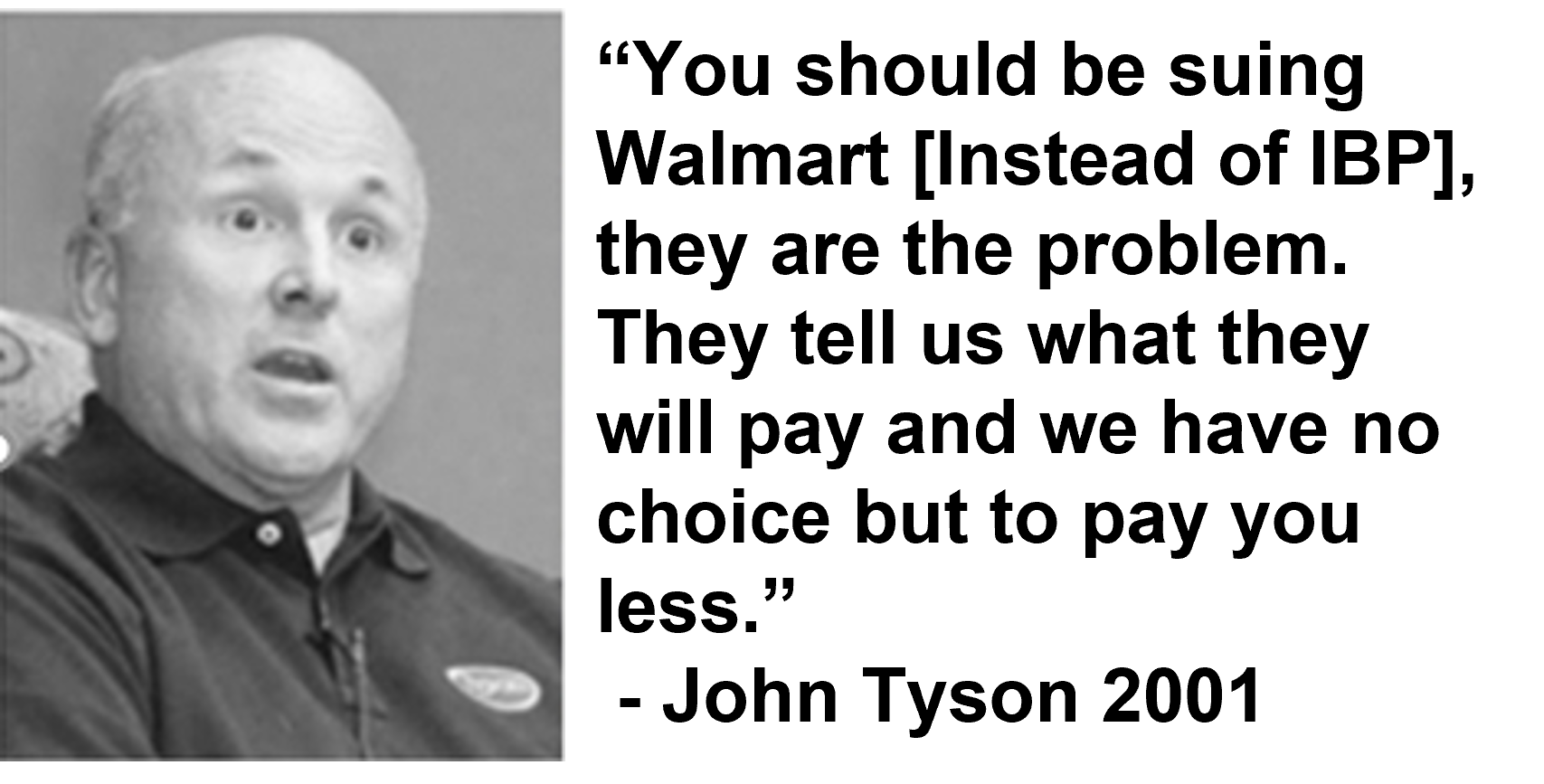

The 2001 NCBA Convention was my last. I introduced myself to John Tyson as a plaintiff in the IBP lawsuit. He asked, “What lawsuit?” I told him it was a private action based on the 1921 Packers and Stockyards Act, and if we were successful, the lawsuit could cost IBP more than it’s entire market capitalization. He said he knew all about the Packers and Stockyards Act. I responded, yes I know you do, and had it been properly enforced, you wouldn’t be where you are today in the chicken industry. He went on to blame Walmart and departed to address the convention:

When the Omaha based Federal judge, Lyle E. Strom, reversed the jury’s verdict and the $1.28 billion dollar jury award in the Tyson/IBP case, we lost our last chance to fix what little was left of the cattle market.

Walmart was likely another very good reason for Tyson’s interest in IBP. Money was cheap, and with Tyson’s cozy and nearly exclusive supplier arrangement with Walmart, the opportunity to manage and control both the supply and demand for all three major meat categories, beef, pork and poultry, was an extraordinary opportunity. Since the 1996 merger that created NCBA, the organization had been a dependable ally of the big meatpackers and could be depended on to pacify producers.

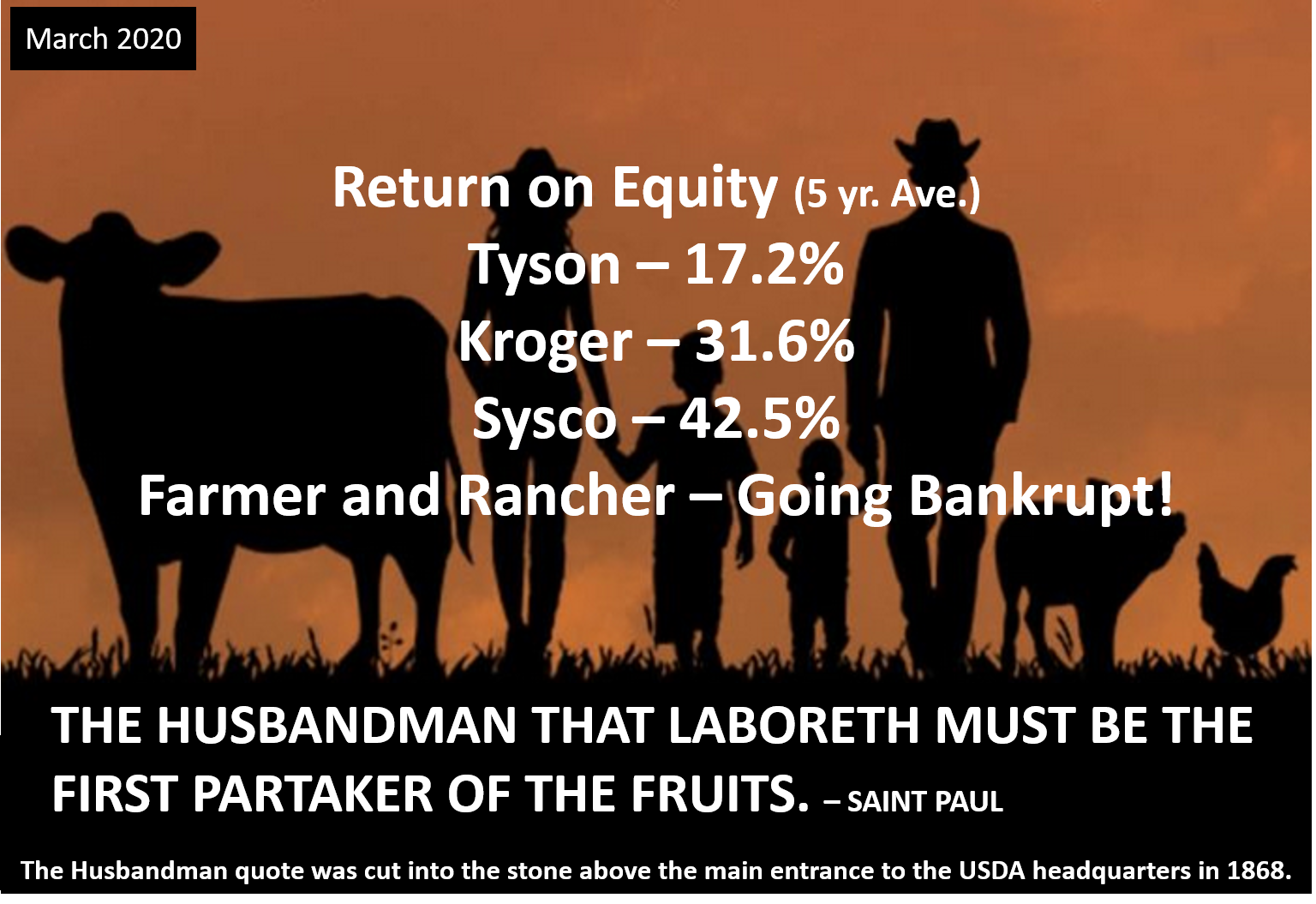

Cattlemen today, even more than captured poultry growers, have seen their equity systematically transferred to the balance sheets of the big food cartel. Tyson and Walmart, with the help of NCBA, have led the way to today’s disaster – the most concentrated, consolidated, unfair, and fragile food system in history.

Buying the largest beef packer, IBP, while cooperating with the other biggest players in the the meat industry, has worked out very well for Tyson and the meat cartel, while leaving the rest of America and the world with little choice of where food will come from?

Can we really look for solutions to come out of this week’s NCBA/meatpacker convention?

To understand more about how we got here and why we should care listen to the Charter ranch story.

We must NEVER allow the packers to own the cattle stock, too!

When they do, it will be just like the egg and meat chickens, turkeys and now, our pork!

I watched [in horror] the transition of the packers literally highjack the commercial pork farming, with vertical integration, and that was finally consummated, about the same time the organization transitioned from the old, solid N.C.A. to ”N.C.B.A.” and Derry Brownfield was RIGHT!

Judge rules Tyson Foods ‘improperly terminated’ merger for meatpacker

https://money.cnn.com/2001/06/15/deals/tyson/?fbclid=IwAR2DO5Df9T9wpeJnH2CLs9GE_6yg3ueOSa5xFo8KsGnj6nUL6Il-Q9G7um8

Tyson ordered to buy IBP June 15, 2001: 5:50 p.m. ET

Judge rules Tyson Foods ‘improperly terminated’ merger for meatpacker

NEW YORK (CNNfn) – Tyson Foods Inc. must go through with its $3.2 billion cash and stock acquisition of meatpacker IBP Inc., a Delaware Chancery Court ruled Friday.

Vice Chancellor Leo E. Strine Jr. was not convinced of Tyson’s claims it received misleading financial information from IBP and ruled Tyson improperly terminated its agreement, IBP said.

Tyson said it would be premature to comment until it has read the entire opinion.

Strine said in the ruling his only alternative would be to award damages to IBP, but such a figure would have been “very difficult and any award would be staggeringly large.” In addition to paying $3.2 billion for IBP stock, Tyson must also assume $1.5 billion in debt.

IBP said Strine agreed with its position that “Tyson wished it has paid less especially in view of its own compromised 2001 performance and IBP’s slow 2001 results.”

“As we stated during the trial, it still makes strategic sense for these two great companies to team up,” said IBP Chairman Robert L. Petersen, in a statement.

graphic

Tyson called off the $30-per-share proposed merger in late March, stating it relied on misleading information in determining to enter into a merger. IBP restated its financial statements at the request of the Securities and Exchange Commission.

Dakota Dunes, S.D.-based IBP (IBP: Research, Estimates) then sued to force Tyson to go though with the merger. IBP claimed Tyson was unjustified when its pulled its plans for the takeover, the company said in a suit filed in Delaware Chancery court. IBP says Tyson officials were routinely notified of potential charges at IBP unit DFG Foods, both before and after the merger agreement was signed.

Analyst John McMillin of Prudential Securities Inc. predicted the two companies would not end up merging and that Tyson would pay IBP to get out of the deal.

“I wouldn’t look for a shotgun wedding. I’d look for a number that can settle the situation,” McMillin said.

On Jan. 1, Springdale, Ark.-based Tyson, the largest U.S. chicken producer, won the bidding war against Smithfield Foods (SFD: Research, Estimates), the No. 1 U.S. pork processor, for IBP.

Terms of the merger agreement called for Tyson to pay $30 per share cash for 50.1 percent of IBP’s outstanding shares and the equivalent of $30 per share in stock for the remaining stake. Tyson will also assume $1.5 billion in IBP debt, up slightly from its original projection of $1.4 billion.

Shares of Tyson (TSN: Research, Estimates) fell 5 cents to $11.38, and IBP fell 23 cents to $18.27 in regular trading.

In after-hours trading, shares of IBP jumped $3.23 to $21.50 while Tyson shares fell $1.38 to $10. graphic